The company has spent billions on litigations about one of its most popular products. So its executives tried a brazen new legal strategy to stop those litigation, and corporate America quickly took note.

But the court threw out the J&J case, a victory for consumers.

Here’s the back story.

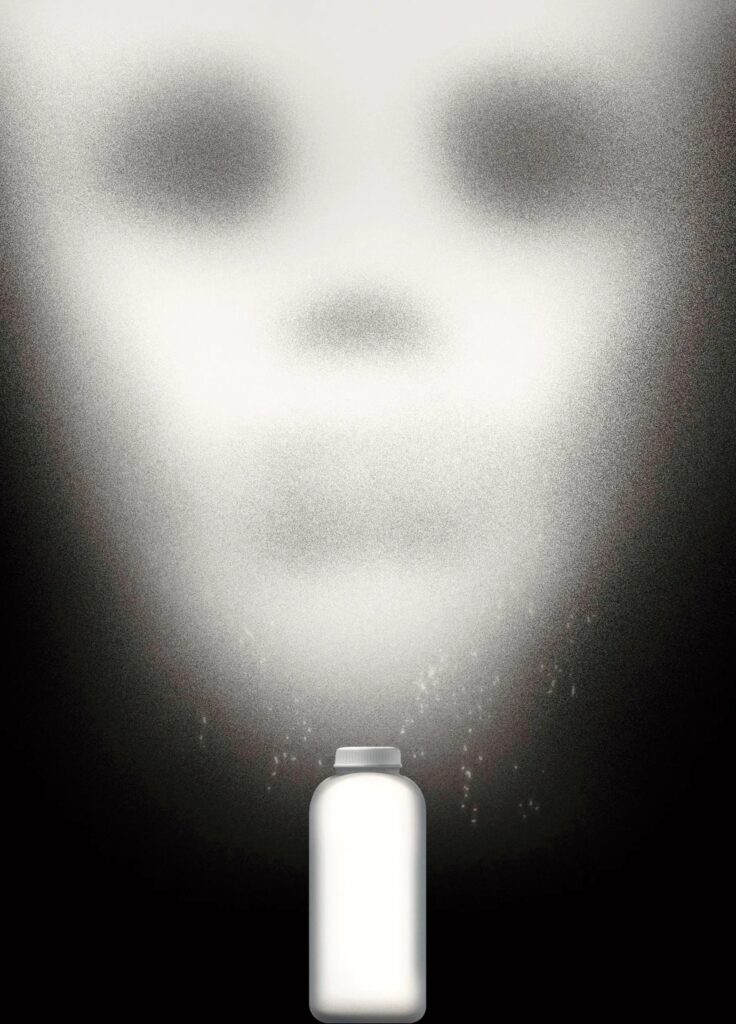

ABOVE: Tens of thousands of women have filed lawsuits against the company, alleging that its baby powder gave them cancer.

31 January 2023 — Yesterday, a federal appeals court in Philadelphia rejected Johnson & Johnson ‘s use of chapter 11 bankruptcy to freeze roughly 40,000 lawsuits linking its talc products to cancer, blunting a strategy the consumer health giant and a handful of other profitable companies have used to sidestep jury trials. The court dismissed the chapter 11 case of J&J subsidiary LTL Management LLC, which the company created in 2021 to move the talc injury lawsuits to bankruptcy court and freeze them in place. J&J is now exposed once again to talc-related cancer claims that have cost the company’s consumer business $4.5 billion in recent years and are expected to continue for decades.

J&J tried to stanch those costs through an emerging corporate restructuring strategy that offered J&J and other companies the protections of bankruptcy, despite their solvent balance sheets and solid credit ratings, and put a total of more than 250,000 injury lawsuits against the businesses on hold. Monday’s decision marks the first time a federal appeals court has disapproved of the bankruptcy strategy, known in legal circles as the Texas Two-Step.

And, of course, a Johnson & Johnson spokeswoman said the company would challenge Monday’s ruling and that it put its subsidiary LTL into bankruptcy to equitably resolve the talc litigation for current and future injury claimants.

There is a huge backstory to all of this. Casey Cep, a journalist and New York Times bestselling author, and a staff writer at The New Yorker and The Paris Review, has done a monumental job putting this all together. Her analysis appeared last fall in The New Yorker and it follows below.

* * * * * * * * * * * * * * *

God gives you only one body, Deane Berg always said, so you’d better take care of the one you’ve got. A physician assistant at the veterans’ hospital in Sioux Falls, South Dakota, she knew that spotting between periods wasn’t unusual for a forty-nine-year-old woman, but she went to the doctor anyway. Her two daughters had already lost their father to lung cancer, so Berg wanted to stick around.

Just perimenopause, the doctor concluded after a cursory examination. Probably a blood clot, the nurse practitioner told her when a subsequent ultrasound showed something on an ovary. “It’s not going to be cancer,” the gynecological surgeon said before removing both ovaries on the day after Christmas in 2006. But, when Berg went for her follow-up, she read the words on the pathology report before the surgeon had a chance to break the news: serous carcinoma. She cried, and the surgeon did, too. She would now need a full hysterectomy, chemotherapy, and a great deal of luck. Every year, around twenty thousand women are given a diagnosis of ovarian cancer in the United States, and more than half that many will die of the disease.

Berg told herself that twenty-six years of caring for patients might help her get through the treatments ahead. But her experience with veterans’ port-a-caths did not make it any less painful to have them implanted in her own abdomen and chest; nausea and headaches were no more manageable because she’d counselled others through them. And nothing prepares a person for losing her hair and much of her hearing or developing nerve damage in her hands and feet or having her teeth crack from chemo. Weak and immunocompromised, Berg left her job at the hospital, which meant she had more time to study the handouts about ovarian cancer that nurses had given her when she was diagnosed.

One of those pamphlets was distributed by Gilda’s Club, a group founded by friends of the comedian Gilda Radner, who died of the disease in 1989, when she was only forty-two. The pamphlet included a list of risk factors, which Berg went through one by one. No, she didn’t have a family history of reproductive cancer; no, she hadn’t struggled with infertility and had never used fertility drugs; no, she had never had cancer before; no, she had never had an unhealthy diet or been overweight. Then she came to a section about talcum powder. After reading it, she went to look at the big container of Johnson & Johnson body powder she kept in her bathroom to use after daily showers and the little bottle of Johnson & Johnson baby powder she took with her whenever she travelled. Both listed talc as an ingredient.

Berg immediately posted a message on the forum of the Ovarian Cancer Research Alliance, asking if any other women thought their cancer might have been caused by talcum powder. Only two people replied. The first was a cancer researcher in Illinois who had been trying for more than a decade to get the U.S. Food and Drug Administration to warn American customers that talc could be a carcinogen. The second was R. Allen Smith, Jr., an attorney in Mississippi. He was interested in talking to her about a lawsuit against Johnson & Johnson; she wasn’t convinced he was a real lawyer.

Smith did in fact practice law, and, years before, his father, a doctor, had tipped him off to a contentious debate over the safety of talc—one that continues to this day. A study published in 2020 in the Journal of the American Medical Association, which pooled data from four earlier long-term observational studies and involved a quarter of a million women, found no statistically significant link between talc and ovarian cancer. But, as its authors noted, the underlying studies did not always distinguish between powders that contained talc and those which did not, and were not consistent in asking participants how often or for how long they’d powdered themselves. Many other studies, meanwhile, found a significantly increased risk of ovarian cancer in women who used talc for feminine hygiene—in their underwear, on their sanitary napkins, for storing their diaphragms.

Determining the etiology of diseases is difficult, especially when it comes to cancers, which often have long latency periods and multifactorial causes. But the evidence against talc had grown substantial enough by the time Berg was diagnosed that many U.S. manufacturers, including the makers of crayons, condoms, and surgical gloves, had erred on the side of caution and stopped using it in their products. Why hadn’t Johnson & Johnson done the same, when an alternative, cornstarch, was cheap, abundant, and safer?

Johnson & Johnson is one of America’s most trusted companies, and as Berg moved through her cycles of chemotherapy she kept thinking about a slogan for its body powder: “A sprinkle a day helps keep odor away.” For more than thirty years, she had taken that advice, applying the powder between her legs to prevent chafing. But that powder wasn’t like her chemo drugs: their side effects were awful, but they were keeping her alive. The powder felt, instead, like an unnecessary gamble, one she thought other people should be warned about.

All along, Berg had worried about her daughters—not only how they’d fare if she died but whether her diagnosis meant they had a greater inherited risk of cancer. In 2007, to find out, she underwent genetic testing and learned that she had neither of the two main mutations that increase the odds of developing reproductive cancers. Two years later, she had her ovarian tissue tested, and the pathologist found talc in one ovary. Shortly afterward, with her cancer in remission, she decided to sue, in what became the first baby-powder lawsuit against Johnson & Johnson to ever make it to trial.

Almost every American, from nursery to deathbed, uses Johnson & Johnson products: baby shampoo, Band-Aids, Neosporin, Rogaine, and O.B. tampons; Tylenol, Imodium, Motrin, and Zyrtec; Listerine mouthwash and Nicorette gum; Aveeno lotion and Neutrogena cleanser; catheters and stents for the heart; balloons for dilating the ear, nose, and throat; hemostats and staples; ankle, hip, shoulder, and knee replacements; breast implants; Acuvue contact lenses. But what few of those consumers grasped until a series of baby-powder cases began to go to trial was that, for decades, the company had known that its powders could contain asbestos, among the world’s deadliest carcinogens.

Slippery to the touch and soft enough to flake with your fingernail, the mineral talc is found all around the world, in deposits that can be more than a billion years old. Such deposits are sometimes laced with actinolite, anthophyllite, chrysotile, and tremolite. These accessory minerals, better known in their fibrous form as asbestos, grow alongside talc like weeds in a geological garden. As early as 1971, Johnson & Johnson scientists had become aware of reports about asbestos in talc. They and others also worried about a connection between cancer and talc itself, whether or not it contained asbestos. By the time of Berg’s diagnosis, the World Health Organization’s International Agency for Research on Cancer had designated talc containing fibrous particles a carcinogen and the genital application of any talc powder possibly carcinogenic. The F.D.A. had safety concerns, too, but its authority over products like baby powder was and remains, in the words of Ann Witt, a former senior official at the agency, “so minimal it’s laughable.”

Johnson & Johnson has always insisted, including to this magazine, that its baby powder is “safe, asbestos-free, and does not cause cancer”; however, a 2016 investigation by Bloomberg and subsequent revelations by Reuters and the New York Times, based in part on documents that surfaced because of discovery in suits like Berg’s, exposed the possible health risk related to its powders. Following those reports, tens of thousands of people filed suits against the company, alleging that its products had caused their cancers. In 2020, after juries awarded some of those plaintiffs damages that collectively exceeded billions of dollars, Johnson & Johnson announced that it would no longer supply the talc-based version of its product to American stores.

And then, quietly, the company embraced a strategy to circumvent juries entirely. Deploying a legal maneuver first used by Koch Industries, Johnson & Johnson, a company valued at nearly half a trillion dollars, with a credit rating higher than that of the United States government, declared bankruptcy. Because of that move, the fate of forty thousand current lawsuits and the possibility of future claims by cancer victims or their survivors now rests with a single bankruptcy judge in the company’s home state, New Jersey. If Johnson & Johnson prevails and, as Berg puts it, “weasels its way out of everything,” the case could usher in a new era in which the government has diminished power to enforce consumer-protection laws, citizens don’t get to make their case before a jury of their peers when those laws fail, and even corporations with long histories of documented harm will get to decide how much, if anything, they owe their victims.

When the Civil War ended, Robert Wood Johnson was a lowly drug clerk in Manhattan with a knack for trading on the medical bona fides of others. In his first business venture, with a prosperous pharmacist named George Seabury, Johnson appropriated the name of Joseph Lister, the British aseptic-surgery pioneer, to sell a line of sterile sutures and gauze. Later, he split from Seabury so that he and two of his brothers could incorporate as Johnson & Johnson. The company plastered the red cross of Clara Barton’s humanitarian organization on its product line and refused to stop, even when Congress tried to prohibit anyone but the Red Cross from using the emblem. (Eventually, the company went so far as to sue the nonprofit for trademark infringement. The judge was not impressed.)

To further burnish its scientific image, Johnson & Johnson gave away millions of medical pamphlets that doubled as advertisements for its products. One pamphlet issued in 1902, titled “Hygiene in Maternity,” marketed at-home birth kits, which included sanitary soap, abdominal binders, umbilical tape, sterile bags, and a recent innovation: baby powder, created by Johnson & Johnson’s first scientific director, Frederick Barnett Kilmer. He had realized that talc could be used to soothe irritations caused by adhesive bandages and diaper rash. Kilmer’s powder went to market in square cannisters that stayed put when lively infants kicked them; for a while, the packaging featured a picture of Robert Wood Johnson’s granddaughter.

Despite accounting for a tiny percentage of Johnson & Johnson’s annual revenue, baby powder provided entrée for the brand into households around the world and was foundational to its family-friendly reputation. According to one company estimate, between 1930 and 1990, baby powder was used on roughly half the children born in the United States. A marketing PowerPoint from 1998 described the baby division as the company’s “#1 asset,” critical to the “deep personal trust” that consumers had for the brand over all. So popular was the baby powder that the company had bought talc mines to bolster and control its supply, selling off some of the talc for use in roofing and paint products and keeping the rest for use on humans. The company’s mines were in Vermont, where many of the talc deposits are thought to contain asbestos. (Geologists working for the state noted the ubiquity of asbestos there as early as 1872.)

Asbestos, which is considered dangerous even in small amounts, is found throughout the world, in building materials and brake pads, and it can also exist, unknown to people, in background levels in their water and soil. It is tricky to detect in talcum products, because the fibres are small and can closely resemble talc. Since the nineteen-forties, Johnson & Johnson has tried to monitor its supply chain, regularly testing talc from its mines and from its other suppliers. Most of the tests it commissioned found no asbestos. However, according to internal documents, dozens of tests have found minerals such as tremolite, chrysotile, and actinolite—which, in certain forms, constitute asbestos—in the company’s talc.

In a statement to The New Yorker, Johnson & Johnson denied that internal testing found “asbestos in talc that was being used by the company.” But company scientists were concerned about the diseases related to asbestos and talc. As one of them, Dr. T. M. Thompson, noted in a 1969 memo to a senior executive, pediatricians had been “expressing concern over the possibility of the adverse effects on the lungs of babies or mothers who might inhale any substantial amounts of our talc formulations.” He warned his colleagues, “It is not inconceivable that we could become involved in litigation in which pulmonary fibrosis or other changes might be rightfully or wrongfully attributed to inhalation of our powder formulations. It might be that someone in the Law Department should be consulted with regard to the defensibility of our position in the event that such a situation could ever arise.”

It wasn’t only pulmonary diseases that were of interest to the company scientists. In 1971, a team of researchers in Wales analyzing the tissue of reproductive-cancer patients found that most of their cervical and ovarian tumors had talc in them. Their study, published in the Journal of Obstetrics and Gynaecology, was the first to suggest a link between talc and ovarian cancer. Within a month, Johnson & Johnson executives sent employees to Cardiff to meet with its authors. According to company minutes of that meeting, the Welsh researchers speculated that the talc might have spread to the reproductive organs via the bloodstream after women inhaled it, or entered their reproductive tracts through their vaginas. Johnson & Johnson got some of the team’s tissue samples to do further testing. Scientists hired by the company not only confirmed the presence of talc in the samples; some of them found asbestos in the tumors as well. (Johnson & Johnson maintains that the samples could have been contaminated.)

In that era, Johnson & Johnson was conducting other research on talc as well. Beginning in 1967, the company funded several experiments on prisoners, mostly Black men at Holmesburg Prison, in Philadelphia. Internal company records detail how the subjects were given blisters with a chemical-burn agent, then had their wounds dusted three times a day with talc. Four years later, other men were injected with talc and two forms of asbestos so that the company could measure the inflammation they developed after exposure. As Allen Hornblum documented in the 1998 book “Acres of Skin,” those talc studies were only some of the experiments Johnson & Johnson carried out on prisoners. Others included paying inmates “five dollars per wound” for testing the absorbency and adhesiveness of the company’s dressings and paying them three dollars each to have shampoo dropped in their eyes regularly for twenty-four hours to help the company perfect the formula for its signature baby shampoo, No More Tears.

Eventually, some in the company began to worry that talc posed a reputational risk. In 2008, the year before Berg filed her lawsuit, its global creative director, Todd True, sent an e-mail to colleagues with the subject line “Best for baby.” He asked, “Have we done any research to determine the potential negative impact to our brand or best for baby strategy by maintaining this ingredient? Have we looked at replacing talc with cornstarch for our base powder as other brands have? What’s the value in maintaining talc under baby aside from cost?” Three days later, he wrote again to suggest that the company “simply replace the talc ingredient” in its baby products. Doing so, he added, “seems like an easy fix and win.”

But Johnson & Johnson did not change the central ingredient in its baby powder. It changed its marketing strategy. In the sixties, as pediatricians began worrying about the suffocation risks that talcum powder posed for babies and major studies were finding asbestos to be carcinogenic even in small doses, Johnson & Johnson was pitching its powder aggressively to adults. One advertisement featured Hammerin’ Harmon Killebrew, the Minnesota Twins Hall of Famer, saying, “Mama taught me it takes more than a towel to really get dry.” The company also introduced a “deodorant body powder,” Shower to Shower, eventually packing it in pink bottles for women and promising “a freshness that stays with you until you wash it away.” In 2007, after the International Agency for Research on Cancer issued its warning about talc powder, Johnson & Johnson had a new focus, according to internal marketing presentations, on “overweight” and “African-American” consumers, then more broadly on “ethnic consumers,” which it pursued through giveaways at churches, beauty parlors, and barbershops in Black and Hispanic neighborhoods. In 2010, the company targeted “curvy Southern women 18-49 skewing African American,” emphasizing that powder helps with body odor and chafing in hot climates. And even after Johnson & Johnson pulled its talc-based powder from U.S. and Canadian markets, in 2020, the company kept selling it elsewhere, including China, Indonesia, and Pakistan, as well as in India, where using the American brand has become a status symbol for women and teen-age girls. Only a few weeks ago did Johnson & Johnson finally announce that it was getting out of the talc business altogether. Not right away, though. Rather than pull its product from shelves, it will simply sell the talc-based powder overseas into next year, until it’s gone.

Johnson & Johnson’s baby powder is classified by the F.D.A. as a cosmetic, a type of product over which the agency has extremely limited authority. In the Federal Food, Drug, and Cosmetics Act, a document of more than eight hundred pages, only two pages address cosmetics, a category that encompasses not just lipstick, mascara, moisturizer, anti-aging serums, and everything else in the makeup aisle but also products that most Americans use every day, including toothpaste, deodorant, and shampoo.

The responsibility for regulating the eighty-five-billion-dollar cosmetics industry falls to the F.D.A.’s Division of Cosmetics, which has just thirty employees and an annual budget of less than ten million dollars: a rounding error in the agency’s six-billion-dollar budget and a twentieth of what it spends regulating food and drugs for pets. The marginal status of cosmetics at the F.D.A. stems in part from the difference between acute and chronic risk: it’s easier to defer regulation for products that cause injury or death only after years of cumulative exposure. But another reason cosmetics are barely regulated is that the industry has successfully fought for more than eighty years to keep Congress from updating the rules that cosmetic companies must abide by. Today, such companies are not legally required to test their products for safety before selling them. They do not have to register with the F.D.A. or provide ingredient statements, and they do not have to produce their safety records for scrutiny or report adverse events, whether rashes or headaches or early puberty or even cancer. If a cosmetic product is life-threatening, the agency cannot recall that product or suspend production; it can only encourage a company to do so. “These are some of our most broken laws,” Scott Faber, who leads government affairs at the Environmental Working Group, a nonprofit research organization, told me. By the E.W.G.’s count, more than eighty countries, from the United Kingdom to Cambodia to Myanmar, have enacted stronger cosmetics regulations than the United States. And whereas some countries’ regulators have banned more than twenty-four hundred cosmetic ingredients, from parabens to formaldehyde, the F.D.A. has banned or restricted fewer than a dozen.

“People think if there’s a problem the government would address it, but cosmetics is probably the best example of weak regulatory action leaving the American people unprotected,” the epidemiologist David Michaels told me. Michaels, the former head of the Occupational Safety and Health Administration and the author of “The Triumph of Doubt: Dark Money and the Science of Deception,” sees talc as a case study in what he calls “working the refs,” whereby an industry successfully resists oversight by interfering with the most basic terms of regulation, from definitions to measurements to methodologies. By way of illustration, he points to a powerful voice in the cosmetics industry: a trade group once called the Cosmetic, Toiletry, and Fragrance Association, and now known as the Personal Care Products Council.

The C.T.F.A. demonstrated its clout in the seventies, when advocacy groups, among them the Center for Science in the Public Interest and the Environmental Defense Fund, began urging the F.D.A. to regulate asbestos in cosmetics. In 1973, the agency proposed a rule that would require talc to be “at least 99.9 percent free of amphibole types of asbestos fibers and at least 99.99 percent free of chrysotile asbestos fibers.” The C.T.F.A. had just hired a young lobbyist, E. Edward Kavanaugh, the father of the Supreme Court Justice Brett Kavanaugh, who would go on to run the organization for twenty years; according to 990 forms that the C.T.F.A. submitted to the I.R.S., he eventually earned an annual salary package of four and a half million dollars.

The trade group organized a “talc task force” to resist the new standard. Among companies that would be affected were, in addition to Johnson & Johnson, Avon, which made Unforgettable Perfumed Talc, and Colgate-Palmolive, which made Cashmere Bouquet—companies that would also go on to face lawsuits alleging that their talcum powder caused cancer.

The C.T.F.A. homed in on the F.D.A.’s proposed testing method, alleging that it “results in both false-positive and false-negative findings” and that it was burdensomely “tedious.” As the C.T.F.A. advocated for a less sensitive testing method, an employee at one of the member companies told colleagues in a memo that they probably wouldn’t have to worry too much about a new F.D.A. limit on asbestos, as regulators “have neither the money nor the manpower to pursue matters so that they will have airtight cases in scientific matters.”

By 1976, the F.D.A. had all but given up regulating asbestos in talc, in part because Johnson & Johnson, which had the lion’s share of the powder market, had encouraged the C.T.F.A. to preëmpt government regulation with self-regulation. The group approved an industry-wide, voluntary standard that cosmetic talc should contain “no detectable fibrous, asbestos minerals.” Then the members chose their own detection method—one that didn’t test for chrysotile asbestos and could only show levels of amphibole asbestos when they were five times higher than what the F.D.A. had originally proposed. The epidemiologist David Egilman, who has studied asbestos and testified as a witness on behalf of plaintiffs in talc lawsuits, compared this to companies placing needles on a bathroom scale and then denying that those needles existed because they didn’t weigh enough to register. (A lawsuit brought against P.C.P.C. alleging negligence and conspiracy was dismissed by a New Jersey judge last year.)

Cosmetic companies have since used the voluntary standard to claim that talc products made after 1976 are “asbestos-free,” a claim repeated far and wide, including on a part of Johnson & Johnson’s Web site dedicated to “The Facts About Talc Safety.” The trade group and its allies also used the voluntary standard to challenge medical literature showing a correlation between talc and cancer. Any incidence of cancer that predated the standard might have come from asbestos in talc, the industry argument goes. And since talc is now thoroughly tested for asbestos, no further regulation is necessary. The only problem is that as recently as 2019 the F.D.A. found asbestos in several talc products on store shelves, including in one bottle of Johnson & Johnson baby powder. (A company statement blames testing error or contamination. The F.D.A. stands by its findings.)

Another C.T.F.A. success came in late 2000, after the National Toxicology Program, which is part of the Department of Health and Human Services, first considered classifying talc as a carcinogen, whether or not it contained asbestiform fibres. As one supplier warned his industry colleagues in a presentation, if the N.T.P. declared talc a carcinogen, “civil litigation would likely skyrocket” and there would be “a virtual immediate loss of our sales.” So the C.T.F.A. worked with some of the same product-defense firms that tobacco companies used in their fight against regulation, including the Weinberg Group and the Center for Regulatory Effectiveness, to create confusion about the definition of talc and to deploy the voluntary asbestos standard against the N.T.P. Although an overwhelming majority of the N.T.P.’s scientists had originally voted for the classification, the vote was changed after the campaign. (Talc was later withdrawn from consideration entirely. The only other instance in which the N.T.P. reviewed and then withdrew something from consideration involved a study of the carcinogenic effects of night shift work and light at night.) “We (the talc industry) dodged a bullet in December based entirely on the confusion over the definition issue,” one of Johnson & Johnson’s talc suppliers confided in a private e-mail. But a colleague of his cautioned that there was work left to do in fighting off further regulation: “Time to come up with more confusion!”

Shortly afterward, the C.T.F.A. brought on a new executive: John Bailey, who was hired after he’d served ten years as the head of the F.D.A. office overseeing the Division of Cosmetics. Bailey has since made more than two hundred dollars per hour testifying as an expert witness for Johnson & Johnson and other companies in talc litigation.

There are two levers to pull when it comes to consumer protection: one before the harm is done, and one after. In June of 2013, nearly four years after Deane Berg filed her lawsuit against Johnson & Johnson, she drove five hours to Rapid City to meet with company lawyers, who, she told me, offered her a settlement of eight hundred thousand dollars. Would the company also add a warning label to its baby powder? Berg asked. No, said the lawyers, who then increased the proposed settlement by another half million dollars. The offer was contingent on her never saying that baby powder had caused her cancer. (The company denies this version of events.)

She left the meeting with the lawyers and went for a walk with her second husband, who had come with her for moral support. “You know I didn’t go into this to make a buck,” she told him. “I wanted to get this out there for the public, so women don’t suffer like I did.” When she went back inside, she announced her decision: “If you’re not going to put a warning on the powder and you’re not going to tell women, I’ll see you in court.”

That fall, Berg’s case went before a jury in Sioux Falls. Three experts appeared on her behalf, including Daniel Cramer, an epidemiologist at the Dana-Farber/Harvard Cancer Center, who had published one of the first studies showing an increased risk of ovarian cancer from using talcum powder. Johnson & Johnson had five experts who disputed the link between talc and cancer and suggested that the talc found in Berg’s ovary was from contamination of the sample at the hospital where she was treated.

The trial lasted two weeks. Berg’s lawyers warned her that South Dakota juries often sided with defendants in product-liability cases, but, whatever the outcome, her case was already significant. Even though the company had challenged every one of her expert witnesses, they had all been accepted by the court, clearing a crucial judicial hurdle known as the Daubert standard.

During the two days that the jury spent deliberating, a blizzard descended on South Dakota. Berg, sitting at the plaintiff’s table, was struck by how silent the courtroom was when the jurors returned with a verdict: Johnson & Johnson was guilty of negligence. One of the company’s lawyers slammed a notebook shut. Then the clerk turned to the matter of compensatory and punitive damages—how much Berg would receive for her medical expenses and how much Johnson & Johnson would have to pay her for its failure to warn consumers of the risk of cancer associated with its product. The amount, in both categories, was the same: nothing.

For a jury to find a company guilty of negligence yet award no damages is rare, and to a different plaintiff that outcome might have been devastating. But Berg, who had turned down more than a million dollars in order to warn other women, found peace in the knowledge that, whatever else had happened, she had made it easier for future plaintiffs to fare better. Which they did, until they didn’t. Once juries started turning against Johnson & Johnson, Johnson & Johnson, looking for a better way out of mass litigation, turned against juries.

It wasn’t that Johnson & Johnson always lost in court; on the contrary, the company ultimately prevailed in most of the talc cases that went to trial. But, when it lost, it lost big. In 2016, juries in Missouri awarded seventy-two million dollars to the family of a woman who died of ovarian cancer, then fifty-five million and seventy million to two women living with the disease. In 2020, the company settled more than a thousand cases for around a hundred million dollars total, and, in a separate suit, twenty-two women were together awarded more than four billion dollars in damages. On appeal, some of the awards were reduced or overturned. But last year the company, in its Securities and Exchange Commission filing, disclosed that it had set aside $3.9 billion primarily for talc-related litigation.

By then, the bulk of the talc lawsuits had been organized into what is known as multi-district litigation. M.D.L.s can involve thousands of plaintiffs and hundreds of lawyers, mostly pursuing damages from large companies accused of producing defective drugs or faulty products or compromising consumer data. In theory, M.D.L.s are economical, efficient, and more equitable than other mass torts. By combining pretrial work like depositions and discovery, they streamline litigation, unclogging the federal courts and saving both sides time and fees. They can also produce more consistent rulings than stand-alone cases, thereby avoiding lottery-like outcomes in which some plaintiffs receive huge verdicts and others, like Deane Berg, get nothing.

In reality, however, almost everyone involved in M.D.L.s hates them. Defendants complain that plaintiffs are poorly vetted, and an estimated thirty to forty per cent of them are later found to be ineligible or even fraudulent. (Johnson & Johnson estimates that plaintiff firms have collectively spent as much as four and a half million dollars per month on advertising to recruit women with ovarian cancer as clients.) Plaintiffs, meanwhile, dislike the impersonal nature of consolidated representation and the high fees involved, which include lawyers’ billable hours, meals, and travel (sometimes on private flights), and can rise to more than forty per cent of settlements. And plaintiffs and defendants alike complain about the sluggishness of the enterprise. M.D.L.s can take years to reach a conclusion, during which time the opposing sides turn into nation-states of sorts, each with its own G.D.P. and factions, to say nothing of its own press secretaries, pundits, dignitaries, emissaries, and even mercenaries, all chasing after a resolution that is technically if preposterously known as “global peace.”

M.D.L. No. 2738 was formed on October 4, 2016, and assigned to the District of New Jersey, where Johnson & Johnson and many other pharmaceutical companies are headquartered. The litigation, which ultimately included more than thirty-eight thousand women with ovarian cancer, was assigned to Judge Freda Wolfson. She spent half a decade sorting through all the pretrial work and selecting what are called the bellwethers: a small sample of plaintiffs whose suits would go to trial, each verdict helping the parties gauge the likely settlement figure, and thereby moving the M.D.L. closer to a conclusion.

Alexandra Lahav, who teaches complex litigation at Cornell Law School, observes that, of the more than a hundred medical-related product-liability M.D.L.s since 2000, only four exclusively affected men. Twenty-two exclusively affected women, including the Johnson & Johnson case and others involving contraceptives such as Yaz and medical devices such as transvaginal mesh. In addition, the women’s cases over all involved far more plaintiffs per case than those affecting men. Lahav believes that these disparities reflect biases in the regulatory apparatus that tolerate greater risks for women than for men. “With women, especially women’s reproductive health, history demonstrates again and again that these products aren’t tested well, the side effects aren’t well known, and there appear to be more adverse events,” Lahav told me. “There’s this sense that it’s O.K. to experiment on women’s bodies in real time.” When such experiments go wrong, they cost companies, but not as much as they might: according to Lahav, lawyers on both sides report that women’s cases are less profitable than cases involving men.

Last summer, Johnson & Johnson reportedly offered somewhere between four and five billion dollars to settle the cases in M.D.L. No. 2738. That deal fell apart, but, in any case, it would not have ended all the litigation the company was facing. Not everyone suing Johnson & Johnson is part of that M.D.L., and not all of the plaintiffs have ovarian cancer. Some are suffering from mesothelioma, a rare and lethal form of cancer, associated with asbestos exposure, that eats away at the thin layer of tissue surrounding the body’s internal organs and often results in death within a year of diagnosis. One of those plaintiffs is Patricia Cook, a fifty-eight-year-old personal trainer and mother of two sons from Virginia Beach. She never lived or worked anywhere near asbestos, but her mother had been an employee of Johnson & Johnson and encouraged her daughters to use the company’s products. Cook began using baby powder when she was twelve—applying it, like Deane Berg, after every shower, and later, once she had children, after every diaper change. In 2020, when those children were grown, Cook found a lump on the lower right side of her abdomen. She went in for an ultrasound, and the technician found a nodule behind her cervix. Given the choice between a biopsy and a hysterectomy, she chose the latter, but during the procedure the surgeon found that her reproductive system was riddled with tumors and decided to biopsy as many as he could. “I got the results on MyChart,” she told me: malignant peritoneal mesothelioma.

Historically, mesothelioma has been associated with men who worked in mining or construction, although it sometimes affected their wives and daughters as well. Now, though, according to Michael Becich, a professor at the University of Pittsburgh School of Medicine who runs the National Mesothelioma Virtual Tissue Bank, “we’re seeing a much younger population and also more women.” The Centers for Disease Control and Prevention recently reported that in the past twenty years there has been a twenty-five-per-cent increase in the number of women who died of the disease: four hundred and eighty-nine in 1999 to six hundred and fourteen in 2020, with the highest number of deaths occurring among homemakers. As early as 1997, lawyers working on behalf of Johnson & Johnson to fight a Texas woman’s mesothelioma lawsuit against the company noted in an internal memo that “rare cases of mesothelioma among women with no other identifiable exposure might be related to exposure to cosmetic talc.”

“I was just in shock,” Cook said of her diagnosis. “I spent my life eating healthy and exercising.” She had just wed her second husband, and, she told me, “I hadn’t married him to be my caretaker. We had plans for a long life.” COVID restrictions kept him from being with her in the hospital, where she spent long stretches alone, having her uterus, omentum, gallbladder, appendix, spleen, part of her peritoneum, part of her diaphragm, and some of her intestines removed, then undergoing hyperthermic intraperitoneal chemotherapy, an intensive treatment in which drugs are poured directly into the abdomen.

Partly to cover medical bills and partly hoping to protect other women, Cook filed a lawsuit against Johnson & Johnson. Her lawyers said that her trial would likely begin in May, 2022. But, as her lawyers were preparing their case, Cook learned that it would not move forward. Nor would any of the other cases in state courts or the tens of thousands of cases that were part of the federal M.D.L. Like planes suddenly grounded at every airport in the country, those cases were all stayed when Johnson & Johnson filed for bankruptcy.

Johnson & Johnson’s lawyers would have it be known that their company—officially, Johnson & Johnson Consumer Inc.—never filed for bankruptcy. The company that did so was called LTL Management L.L.C. LTL, which stands for Legacy Talc Litigation, was created in Texas on October 11, 2021, and merged on the following day with—let’s call it Old J. & J. That same day, LTL Management was converted to a limited-liability company based in North Carolina, and two days after that, on October 14th, it filed for Chapter 11 protection in the U.S. Bankruptcy Court in Charlotte.

The L.L.C. that Johnson & Johnson created never had an office or any employees of its own in Texas or North Carolina. It never manufactured or sold talcum powder; for that matter, it never really conducted any business at all before going belly up. Still, in between its formation in one business-friendly jurisdiction and its bankruptcy in another, the new company took on all of Old J. & J.’s talc liabilities. It was suddenly responsible for some forty thousand talc cases, while a new company, also called Johnson & Johnson Consumer Inc., emerged with all of Old J. & J.’s assets—those tens of billions of dollars—and none of its talc liabilities, leaving it free to carry on with its operations.

The bankruptcy route taken by Johnson & Johnson, formally called a divisional merger, is better known as the Texas two-step. Greg Gordon, a partner at Jones Day, the law firm that has represented every company that has attempted the move so far, has observed that although some portray it as “the greatest innovation in the history of bankruptcy,” the two-step is more than thirty years old. It came into being in 1989, when the Texas legislature amended its Business Corporation Act, permitting a single corporation to divide into two or more entities, including when facing extremely expensive litigation.

No corporation was daring enough to try the two-step until 2017, when Koch Industries used it to shield a subsidiary, Georgia-Pacific, from asbestos claims related to its paper and building products. The parent company formed a Texas corporation called, improbably, Bestwall, which declared bankruptcy in North Carolina three months later, spinning off all the asbestos-related liabilities while allowing Georgia-Pacific to continue making billions of dollars in profits through its other products, among them Brawny paper towels, Quilted Northern toilet paper, and Dixie cups.

Johnson & Johnson is the fourth company to attempt the two-step and, thus far, the most brazen, having collapsed the interval between formation and bankruptcy from three months to seventy-two hours. According to a recent Reuters investigation, the two-step plan at Johnson & Johnson was known internally as Project Plato. As one of the lawyers involved wrote in a memo, “It is critical that any activities related to Project Plato, including the mere fact the project exists, be kept in strict confidence.”

Project Plato has succeeded in pausing Patricia Cook’s lawsuit, and the company will be protected from her case and all others in perpetuity if it is granted a non-debtor release, which extends the shield of bankruptcy to non-bankrupt parties. Non-debtor releases were a lightning rod in the Purdue Pharma bankruptcy, when members of the Sackler family sought to be spared future liability by contributing to the company’s opioid settlement fund. These releases were also part of the bankruptcies that followed sexual-abuse cases against USA Gymnastics, the Boy Scouts of America, and Catholic dioceses around the country. In all these cases, the bankruptcy of one entity was used by others—family members, training facilities, insurance companies, individual parishes—to try to minimize financial liability.

In the Texas two-step, such releases are particularly audacious, since they shield not only ancillary parties but also the party with the greatest liability, to say nothing of the greatest assets—in this case, Johnson & Johnson, which is seeking protection from both current suits and future talc litigation. (The company disputes this characterization, and said in a statement, “LTL’s Chapter 11 filing is intended to resolve all claims related to cosmetic talc in a manner that is equitable to all parties.”) Lindsey Simon, a professor at the University of Georgia School of Law, calls such corporate actors “bankruptcy grifters,” since they enjoy the benefits of bankruptcy but don’t suffer any of its burdens, such as transparency requirements, and they do so without, in any meaningful sense, going bankrupt. “They want the good parts of bankruptcy,” she told me, “without any of the bad parts.”

Michael Kaplan, a bankruptcy judge in New Jersey, inherited Johnson & Johnson’s Chapter 11 filing when, in the first sign of how unusual the case was, a bankruptcy judge in the Western District of North Carolina refused to hear it. In February, in response to plaintiffs’ objections, Kaplan ruled that there was “no impropriety” in the use of the Texas two-step. Allowing the bankruptcy to proceed, he appointed Kenneth Feinberg, who administered the September 11th Victim Compensation Fund and the BP Deepwater Horizon Disaster Victim Compensation Fund, to estimate the value of the talc litigation before the end of the year.

That estimate might not matter, though. Critics say that the point of Project Plato was to try to create an entity with limited assets: specifically, two billion dollars so far to settle current and future claims. That figure is less than half of what Johnson & Johnson reportedly offered the ovarian-cancer plaintiffs in the M.D.L. just last summer, to say nothing of what they could owe all the mesothelioma plaintiffs. And, needless to say, it is also far less than the company’s assets. Johnson & Johnson has already spent nearly a billion dollars—half the value of the settlement fund—on its own legal defense. The company’s bankrupt subsidiary, meanwhile, has its own legal costs, including fees paid to Neal Katyal, the former Solicitor General and a current partner at the law firm Hogan Lovells, who charged $2,465 per hour.

“Shameful,” “indefensible,” “complicated trickery that ordinary people don’t have access to”: thus have members of the Senate Judiciary Committee decried Johnson & Johnson’s bankruptcy maneuver. Earlier this year, the committee held a bipartisan hearing on the two-step loophole and whether it could become corporate America’s default way of avoiding consumer liability, letting companies with problem products squeeze through it with billions of dollars in assets intact. Among those who testified at the hearing was a single mother named Kimberly Naranjo.

Naranjo, who had been abused as a young girl, moved in and out of the foster-care system and struggled with addiction until an aunt helped her turn her life around. In 2021, fifteen years sober, she had bought her first house and was starting a new job as an addiction counsellor at the Salt Lake County Sheriff’s Office when she felt a pain in her side. A week later, she learned that the pain was caused by mesothelioma. Naranjo had no known exposure to asbestos, but at twenty, when she had her first child and was trying to be a better mother than her own had been, she began using Johnson & Johnson’s powder at every diaper change. She did the same for six more children, and all along she used baby powder in her underwear and in her shoes, to combat sweat and body odor in the Utah heat.

Her disease forced her to leave her job, and, unable to pay her mortgage, she soon lost the house. When she learned that she could file a lawsuit, she thought that a settlement might help with her medical expenses or provide for her children after her death. Then came the bankruptcy, which stalled cases like hers and kept other women from even filing.

“I am so grateful that you have listened to me,” Naranjo said to those who attended the congressional hearing. “I wish that Johnson & Johnson would listen, too, but they took away that right from me and thousands of other people who have their own stories, families, and lives that also deserve a right to be heard by a jury.”

Judge Kaplan’s ruling allowing the Johnson & Johnson bankruptcy to proceed has been appealed by the Official Committee of Talc Claimants, which was organized by the U.S. Department of Justice to represent the mesothelioma and ovarian-cancer victims in the Chapter 11 case. Lawyers for those plaintiffs called the bankruptcy a “shell game” designed to “slough off [the company’s] responsibility,” and the U.S. Court of Appeals for the Third Circuit is holding an expedited hearing this month to consider these plaintiffs’ challenge.

Elizabeth Chamblee Burch, a professor at the University of Georgia School of Law who studies mass litigation, told me that corporate America is watching the Third Circuit closely. “We’re clearly seeing a strategy here to get the closure every company wants: ending all the state and federal lawsuits at once, reassuring their shareholders everything’s fine,” she said. Burch noted that many companies are exploring strategic bankruptcy as a cheaper, faster way out of mass torts. 3M recently tried to move tens of thousands of lawsuits filed by veterans over its allegedly defective Combat Arms Earplugs into bankruptcy after three years of litigating the cases in an M.D.L. Bayer could decide that bankruptcy court is a better way out of the long-tail liability it faces from its product Roundup, which contains glyphosate, a chemical that plaintiffs claim has been linked to non-Hodgkin’s lymphoma.

Plaintiffs are watching the Third Circuit closely as well. In the summer of 2021, the National Council of Negro Women filed a lawsuit against Johnson & Johnson for false and predatory advertising to communities of color. Because of the two-step, that suit is stayed. And, in July, Johnson & Johnson took the two-step one step further by asking the bankruptcy court for an injunction against the states of Mississippi and New Mexico. Some forty other states are negotiating with Johnson & Johnson’s bankrupt subsidiary to settle their own consumer-protection cases against the company, but those two states were planning to go to trial. If Kaplan stays their cases as well, “principles of federalism [could] vanish,” they allege in their opposition to the injunction, “while a multi-billion-dollar entity contorts the bankruptcy code to shield itself from the states’ constitutional and statutory exercise of their police and regulatory powers.”

If companies can use the two-step to protect themselves from any and all consumer liability, even from states themselves, what’s left to hold them accountable? The Department of Justice has been investigating Johnson & Johnson since 2019, but little is known about the status or the aims of that investigation. The D.O.J. may or may not bring criminal charges. The Third Circuit may or may not toss the bankruptcy case. Congress may or may not curtail the Texas two-step or empower the F.D.A. to regulate cosmetics more effectively. Anything is possible.

But, for now, the only people who have ever held Johnson & Johnson responsible for its actions are those who have served on juries. Deane Berg went to court rather than accept a settlement in the belief that, upon hearing her story, a jury would agree that Johnson & Johnson should have warned consumers about the potential dangers of talc.

Patricia Cook may never get that chance. She knows how deadly mesothelioma is but could not bear to ask her doctors for a prognosis, choosing instead to appreciate every additional day. Kimberly Naranjo, though, is already in hospice care and unlikely to reach what she had taken to calling her “expiration date,” a month before her fiftieth birthday. She knows she won’t live long enough to see justice done. She isn’t even sure what justice would look like.

Yet all of us know what justice doesn’t look like. Johnson & Johnson’s most recent quarterly report shows twenty-four billion dollars in sales, and, in the eleven months since it filed for bankruptcy, an average of one woman a day has died waiting to find out if her case against the company would ever be heard.

* * * * * * * * * * * * * * *

To my readers: for some more details on how the “Texas Two-Step Bankruptcy” works, some additional reading for you:

Wikipedia entry with links to other cases

A more detailed analysis from Harvard Law School

And a good video that explains the Johnson & Johnson case: