The industry is having a midlife crisis. And Twitter is looking less like the free speech “town square” and more like the town circus.

18 November 2022 – The tech industry seems to be in a recession. Although overall unemployment is still very low, just about every major tech company – including Amazon, Meta, Snap, Stripe, Coinbase, Twitter, Robinhood, and Intel – has announced double-digit percentage-point layoffs in the past few months. The stock valuations for many of these companies have fallen more than 50 percent in the past year.

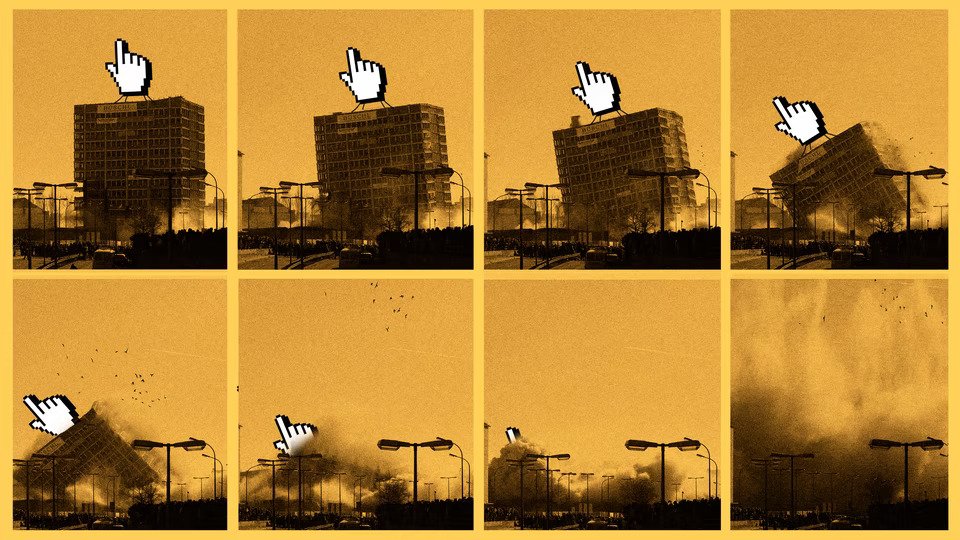

Watching this surge of mass layoffs in big tech companies, plus the lurid chaos unfolding at Twitter over the past few weeks and the spectacular ongoing implosion of crypto, the big question on my mind is: Why is it all happening at once?

Well, according to Derek Thompson, the simple, and possibly simplified, answer to this question is: “It’s the interest rates, stupid”.

NOTE TO READERS: Derek Thompson is a staff writer at The Atlantic Magazine, a “Big Picture” guy who writes about work, technology, and the big theme in tech. He is best known for his best-selling book “Hit Makers: How to Succeed in an Age of Distraction” which I have flogged quite a bit in my posts. The book’s best and most original contribution is a chapter that patiently demolishes the idea that cultural products ever actually “go viral”. The disease model, in which people infect other people who in turn infect others, simply doesn’t explain massive hits. Word of mouth is not that powerful, even on social media. Behind an apparently “viral” wave of popularity, Thompson demonstrates, there is always a massive old-fashioned “broadcast” by one or more star influencers or organisations (Justin Bieber, the New York Times) who already have an audience in the millions, or a “dark broadcast” to a similarly huge audience that marketers don’t know about, for instance the fanfic community. It’s a great read.

Last night in a long blog post (behind a paywall but I’ll quote a few bits) Derek noted:

The period after the Great Recession was defined by a weak economy with low aggregate demand and low interest rates. This created the perfect conditions for an era of endless cash that venture capitalists, seeking high rates of return, poured into low-marginal-cost software companies. As smartphone penetration rose in the U.S. and around the world, the app revolution took off. Social-media and consumer-tech companies became some of the richest and fastest-growing in the world. Hollywood went streaming, content went digital, and the services economy became intermediated by smartphones.

Then came the surge of post-pandemic inflation. Rising interest rates have meant the end of easy money. The Millennial Consumer Subsidy—my term for VCs splitting the bill with consumers to grow their companies—has come to a close. As the cost of risk has gone up, venture funding has gone down, and companies have had to cut costs, raise prices, or both. Meanwhile the narrative in markets has flipped from growth to profits, and valuations for tech companies have crashed.

The inflation explanation is fairly technical. So Derek has another storyline although it is a bit harder to prove. It goes something like this: the tech industry is experiencing a midlife crisis. After using its metaphorical youth to experiment with social media and consumer tech through boundless investment and endless optimizations and A/B tests, many tech executives and investors today feel like they’ve essentially solved the most interesting and important problems of basic digitization.

This is not just his opinion: 4 years ago the tech analyst Ben Evans observed that software had scaled the mountain of advertising and media and connected the world, and tech was looking to climb new mountains and find new challenges. One chapter was closing, and the most prominent tech executives and investors were looking for the next story.

And this is something I have also written about. Executives of the largest tech firms have for years been shifting resources toward new ventures with uncertain returns. Amazon recently employed more than 10,000 people to work on its AI product, Alexa. (Jeff Bezos stepped away from the company he founded to work on rocket ships). At Meta – the parent company of Facebook, Instagram, and WhatsApp – Reality Labs, the division working to build a metaverse, has about 15,000 employees. Apple reportedly has 3,000 people working on an augmented-reality headset, and thousands more are working on Google’s voice assistant.

At the same time, the venture-capital community has been looking for its own moonshot, and many investors have found one (or, at least, have wanted people to believe that they have) in crypto. VCs have reportedly bet dozens of billions of dollars in the space, even though, for all the bluster and investment, it mostly remains a technology in search of a use case beyond betting money on tokens that cash out in dollars. Meanwhile, in what may be a literal midlife crisis, Elon Musk, a car and rocket executive, has installed himself at the helm of a digital delivery mechanism for news outrage with, at best, a chaotic plan for resurrecting its business.

Derek notes it would be unfair to suggest that all of these moves are the emotional equivalent of a 52-year-old man dyeing his hair and trading the minivan for a Corvette. But I think sometimes simple metaphors are useful. Companies going big and spending lots of money on important and difficult problems with uncertain solutions is cool, in a way. But at the moment, a lot of these bets look half-baked, catastrophically expensive, or outright fraudulent.

And observe: these explanations – the macroeconomic one and the psychodynamic one – intersect. The tech industry, which had perfected the art of optimizing digital spaces for engagement and ad placement, was prepared to invest deeply in the next adventure. But it’s gotten smacked down by post-pandemic inflation and rising interest rates, which has made this pivot harder to execute. The result is the current news: mass layoffs across companies that just a few years ago seemed utterly unstoppable.

One mistake that a journalist can make in observing these trends is to assume that, because the software-based tech industry seems to be struggling now, things will stay like this forever. More likely, we are in an intermission between technological epochs. We’ve mostly passed through the browser era, the social-media era, and the smartphone-app-economy era.

But in the past few months, the explosion of artificial-intelligence programs suggests that something quite spectacular and possibly a little terrifying is on the horizon. Ten years from now, looking back on the 2022 tech recession, we may say that this moment was a paroxysm of scandals and layoffs between two discrete movements.

And so an industrialist has purchased Twitter. And he finds out his substantial success launching reusable spaceships does nothing to prepare him for the challenge of building social spaces. The latter calls on every liberal art at once, while the former is just rocket science.

But arguing about the future of Twitter is a loser’s game; a dead end. The platform’s only conclusion can be abandonment: an overdue MySpace-ification. If you followed the Twitter engineer chatter on Slack and Blind it was actually happening before Musk got there but his ignorance and whims accelerated the process. One of my godsons worked at SpaceX and told me Musk was simply repeating what he did at Tesla and SpaceX. No surprise.

Yes, features come and go, little embroideries and fascinations, but the timeline remains, Twitter’s deepest warp. It has been there from the start, its logic invisible, inescapable, non-negotiable. Yes, there are so many ways people might relate to one another online – but Twitter eked out the network effect.

And now we shudder because Twitter’s potential collapse will wipe out vast records of recent human history. What happens when the world’s knowledge is held in a quasi-public square owned by a private company that could soon go out of business?

It’s where the U.S. raid that would result in Osama bin Laden’s death was first announced. It’s where people get updates on Russia’s invasion of Ukraine. It’s where news of the downing of flight MH17, a Malaysia Airlines plane that was likely shot down by pro-Russia forces in Ukraine in 2014, first surfaced. It’s where we learned the real truth behind the murder of George Lloyd and so much other police violence. It is a living, breathing historical document.

If Twitter was to go out tomorrow morning, all of this first-hand evidence of things like atrocities or potential war crimes, and all of this potential evidence would simply disappear. This morning I had a long chat with my Ukraine war coverage team and all the information they have gathered using open-source intelligence (OSINT) – much of it to support prosecutions for war crimes – acts as a record of events long after the human memory fades.

In one sense, this actually represents an enormous opportunity for future historians — we’ve never had the capacity to capture this much data about any previous era in history. But that enormous scale presents a huge storage problem for organizations. For 8 years, the US Library of Congress took it upon itself to maintain a public record of all tweets, but it stopped in 2018, instead selecting only a small number of accounts’ posts to capture. That’s problematic, because Twitter is teeming with significant content from the past 16 years that could help tomorrow’s historians understand the world of today.

But it’s worse. It’s not just OSINT researchers who are worried. US public agencies’ concern about the loss of their verified status highlights the fact that lots of official statements by governments and public bodies are now made on Twitter first. There’s no indication that those formal records of government agencies have ever been archived, or indeed how they’d go about doing that.

But given its trajectory these last 3 years, Twitter’s only conclusion was abandonment. It could not be run as a business and was screaming to be run as a protocol, as a required utility.

I do get the wishful descriptions of Twitter as “the de facto public town square” or “the closest thing we have to a global consciousness”. But at this point is all sounds to me like Peter Pan begging the audience to clap to raise a swooning Tinkerbell.