Is this the wisdom of crowds divining that all this talk of regulations won’t amount to anything?

11 June 2022 – For all the talk of coming regulations squeezing big tech – and Britain’s antitrust regulator issued a new study this week targeting Apple and Google – Wall Street doesn’t seem too bothered.

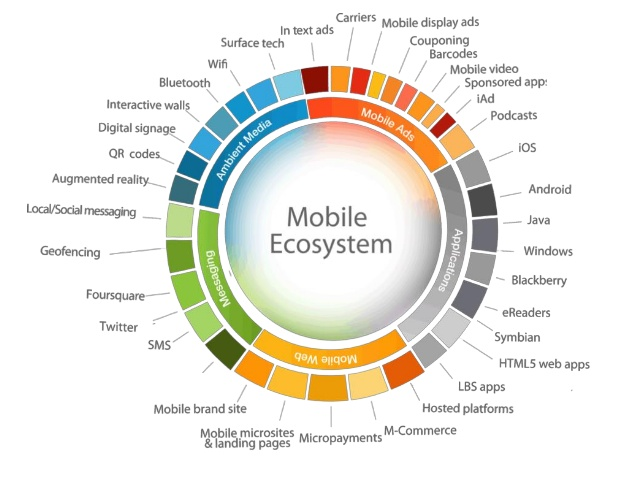

NOTE: the study, issued by the UK Competition & Markets Authority (CMA), is massive – 350+ pages. Titled “Mobile ecosystems”, It is one of the most comprehensive studies on mobile ecosystems I’ve read in a long time – and I read the whole bloody thing last night and this morning. It needs, of course, a re-read because it is chock-a-block with information and stats. You can access it by clicking here.

It is an assessment of the growing body of work by regulators on the systemic barriers that prevent meaningful consumer choice, the pros and cons of whether these systems have stifled innovation online, a complete analysis of almost all mobile devices and operating systems, and a deep look at the concentration of operating systems and affiliated software. Obviously it concludes by saying all of this harms developers and consumers alike. But read purely as a “backgrounder” on the mobile ecosystem it is brilliant. In addition, the CMA’s report is the first to chronicle the importance of web compatibility and the harmful network effects that result when popular software apps are incompatible with all browsers. It also dives into the importance of browser engines to a healthy internet ecosystem that is decentralized and open. Lots and lots of stuff to ponder.

Shares of the iPhone maker and Google’s parent, Alphabet, for instance, have performed better than most tech stocks so far this year, each having fallen around 23%. Is this the wisdom of crowds divining that all this talk of regulations won’t amount to anything? Or do investors have their heads in the sand?

It may be a bit of both. Take the CMA study I noted above – Apple’s and Google’s dominance of the mobile software market (which is a classic example of stating the obvious). Apple makes around 80% of its global revenue from device sales, while Google makes around 90% of its revenue from advertising. Even so, the report makes a good case – as have congressional inquiries in the U.S. – that the companies’ control of their mobile ecosystems can put rival app developers at a disadvantage. But its remedy is to propose another investigation. In other words, more talk, less action.

That doesn’t mean nothing is going to happen, however. In the U.S. Senate, both Democrat and Republican members said they were coming together … 😳 😳 😳 … and there “may” be sufficient votes in the Senate to pass the American Innovation and Choice Online Act, which aims to stop big tech platforms practice of favoring their own services over those of rivals. (Given tech’s heavy lobbying effort against the bill, though, nothing is guaranteed). Meanwhile, the EU is moving closer to adopting a law that restricts what big tech platforms can do, using methods such as forcing a relaxation of the rigid rules governing mobile app stores.

But even assuming these laws pass, it’s unclear precisely what the bottom-line impact will be for Apple and Google. Opening up their app stores by allowing alternative payment methods, for instance, should trim profits, but Morgan Stanley argued in a report last fall that the moves to relax app store rules would have only a minimal impact on Apple’s bottom line. How many consumers will opt to use alternative payment methods, for instance? Still, uncertainty is typically bad for stock prices. Investors’ disinterest in the implications of these changes may come back to bite them.

Meanwhile, there are stock splits galore …

’Tis the season for stock splits. Tesla plans a 3-for-1 stock split, it revealed yesterday in a securities filing, in what will be its second split in two years. Shareholders of Alphabet, meanwhile, last week approved changes to its certificate of incorporation to allow a 20-for-1 stock split to take effect in mid-July. And Amazon just completed its 20-for-1 stock split earlier this week.

For both Alphabet and Amazon, the splits are a way of making their shares more accessible to individual shareholders. Instead of costing $2,228 a share, where Alphabet shares closed today, each share will cost $111 after the split, at least in theory. Amazon shares were trading at a similar above-$2,000 level before its split: It closed yesterday at $109.65.

Tesla isn’t in quite the same boat. While its shares were above $1,000 earlier this year, they’ve fallen sharply since Elon Musk disclosed his investment in Twitter in early April. The stock fell 3% today to $696.69. At that level it should trade closer to $230 after a 3-for-1 split, which could make it more appealing to small investors. And that could give the shares a boost. And right now, Musk would likely appreciate that.