It occurs to me that the term “metaverse” has a lot in common with “information superhighway”, both in the sense of a single unified system, and in the creation of a term well in advance of any actual product. But then it just happens.

Microsoft’s acquisition of Activision Blizzard demonstrates what I mean.

20 January 2022 (Paris, France) – There is a common argument that representative democracy has survived the rise and fall of empires but many digital technologies don’t adhere to the laws, systems or norms that traditionally underpin representative democracies. For a democracy to work reasonably well, citizens have to have the ability to know what they really think about things, to reflect carefully on complex decisions and to engage constructively and meaningfully with each other to find compromises over situations.

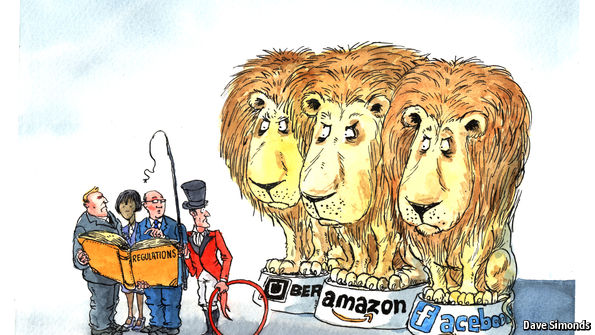

That’s an idealistic vision of how that should work but the argument continues that digital technology does not help us to achieve that at all because it’s all based on immediate, emotional, aggressive, snappy, short messaging. The whole “logic” of how we now communicate is not one that a representative democracy is based on, and technology is increasingly causing a disconnect between our traditional democratic system and our modern lifestyles. And so, “technology must be regulated!!”

The narrative used to be so simple. Technology would allow individuals to be healthier, wealthier, more tightly connected to one another, better informed and more able to communicate, share information and collaborate. It was a promise of greater equality, greater efficiency, greater speed and greater creativity – all enabled by technologies like three-dimensional printers, ubiquitous computing and advances like virtual reality.

But things changed. We were thrown into a pessimistic future: a tiered system of information haves and have-nots; a growth in new and better technologies of global surveillance; a system where rights appear to belong to information and those who collect it rather than to individuals, amidst wider projects of ad hoc geo-engineering and the global diffusion of advanced weapons and other forms of technologically enabled instability.

It was right there in our faces: technological development (although not all of it) that contributed to consumer demand in increasingly sophisticated ways. We never looked at (or maybe just ignored) the societal consequences or the potential downsides. We saw tech solely as consumers, rather than as citizens, and we should have been applying the same civic scrutiny that we would bring to any other form of power.

Technology drives change. And, by definition, change can turn the world upside down. And so, in the end, technology, as a bringer of change, is about politics. Because politics is about who gets what, from whom, under what conditions, and for what purpose. It is why in my upcoming monograph on regulating technology in the modern world I say the regulatory state must be examined through the lens of the reconstruction of the political economy: the ongoing shift from an industrial mode of development to an informational one. That’s where I’ll look at the fast-moving tech regulation bills in the U.S. Senate, the recently unredacted lawsuit against Google by the U.S. Department of Justice that shows the true power and machinations of Big Tech, plus the tandem U.S./EU actions aimed to chip away at Facebook’s and Google’s dominance in advertising, and Amazon’s dominance in … well, everything.

For this post I’ll simply focus on Microsoft’s $68.7 billion acquisition of Activision Blizzard.

Before we get to the wickedly brilliant strategic move by Microsoft, let’s talk antitrust. There are two kinds of antitrust thinking that you see running through conversations about reining in big tech platforms.

The first is narrow and legalistic, focused on core antitrust concepts like market size, definition, and barriers to entry. It’s the more limited approach to antitrust, popular over the past two decades, that frowns on enforcement actions against companies unless they can be shown to increase prices for consumers. It’s the kind of antitrust you see in the recently restored federal lawsuit against Meta, for example.

The second kind of antitrust thinking is broad and free-floating. It says simply: Big Tech is too big. Our futures are increasingly controlled by a small handful of giants. Even when services are cheap or free, they can negatively affect the overall quality of services available, or consumer choice, or our privacy rights. It’s messing up our society. This is the kind of antitrust you see in the American Innovation Act and the Choice Online Act, that latter due to be marked up in the Senate this week, and which would limit the ways big tech platforms use their own services to prevent competition. It’s the subtext of any politician saying “it’s time to break up Big Tech!”

It’s useful to keep this distinction in mind when considering the prospects for the proposed mega-acquisition of the moment: Microsoft’s planned $68.7 billion takeover of gaming giant Activision Blizzard. As its name suggests, the latter company is itself a pile-up of acquisitions. Under CEO Bobby Kotick, Activision came to prominence by acquiring more than 25 gaming/media studios over the past three decades.

NOTE: as my colleague Eric De Grasse noted earlier this week, Activision Bizzard has been battered by bigger issues, revelations of the deep rot in its culture, alongside allegations that Kotick failed to report serious allegations of wrongdoing to the board, that have depressed its once high-flying stock price and led to ongoing worker protests and organizing. Several of its most hotly anticipated games have been delayed amid the chaos.

But it also brought to my mind a bigger issue. Even if this deal gets past the FTC and the DoJ, there is also the question of integration. On Monday Activision said it had fired or pushed out more than three dozen employees and disciplined another 40 since July, to address allegations of sexual harassment and other misconduct at the company, which has nearly 10,000 employees to Microsoft’s 190,000. Microsoft has an extraordinarily high level of employee satisfaction. It’s a pretty good company. You wonder if one of the biggest threats is Microsoft kind of letting the wolf in the door. How is Microsoft going to assimilate an organisation with a culture that is beset by issues to do with misogyny, diversity and harassment over the last number of years which they have failed utterly to remedy? How will Microsoft resolve that? Should the deal go through, Microsoft will have some very “real-world” concerns.

At the same time, Activision Blizzard has some incredible franchises: Call of Duty, Candy Crush, Diablo, World of Warcraft, and Overwatch among them. Perhaps most valuable of all, those franchises have attracted a community of 400 million active monthly players. If you believe that the future of computing is more immersive, and that gaming will be the on-ramp for billions of people to start living their lives in augmented and virtual reality, Activision Blizzard is a hugely attractive target. I’ll address those aspects in more detail below.

As I have noted in numerous posts, Microsoft’s stunning comeback over the last eight years under CEO Satya Nadella has been all about its relentless focus on cloud and enterprise computing. But even as Microsoft dramatically dialed back its ambitions in key categories like internet search and mobile, Nadella held onto Xbox – its most powerful remaining connection to the consumer market. Nadella knows a wounded gazelle when it sees one. Even at $68.7 billion, Activision Blizzard represents only about 3 percent of Microsoft’s current value. A small price to pay to bring some of gaming’s most popular franchises under the Microsoft banner, along with an enormous number of highly engaged new customers. Enough, perhaps, to soften the sting of losing out on that attempted Discord acquisition.

So: a smart move. But will regulators allow it?

In interviews this week, Microsoft executives have projected confidence. Under the first kind of antitrust thinking I outlined above, there may not be much to worry regulators. The move would make Microsoft only the third-biggest gaming company by revenue, after Tencent and Sony, they say. There will be no immediate impact on the price or availability of games; Microsoft has pledged to make its most popular titles broadly available (though without quite promising that you’ll be able to play them on Sony’s PlayStation, its chief rival in console gaming). Moreover, there’s a long history in gaming of hardware manufacturers owning studios; that’s how Nintendo has been set up for decades.

But what about that second kind of antitrust thinking? Should Microsoft, which boasts the second-highest market capitalization of any company in the world at $2.3 trillion, be able to acquire one of the biggest gaming conglomerates in the world? Should Big Tech be allowed to get this much bigger? And what consequences might we see down the road if it does?

In a piece of exquisite timing, the nation’s top antitrust officials held a previously scheduled press conference to announce plans to review rules for approving mergers and acquisitions. In part, the review is intended to modernize antitrust enforcement by considering second-order consequences of free services, such as those offered by Google and Microsoft. But the review also has an element of “Big Tech is too big.” I’ll address this in more detail in my up coming monograph on technology regulation but here’s Cecelia Kang at the New York Times:

Last year, the F.T.C. began a review of guidelines for so-called vertical mergers — the acquisition of companies’ adjacent markets that are part of a supply chain. Tech companies have acquired scores of companies that don’t directly compete with their main businesses, but that have helped giants like Facebook, Amazon and Google spread their tentacles into new markets and maintain their dominance, leaders including Ms. Khan and Mr. Kanter have argued. The announcement by Microsoft, whose main business is in enterprise and consumer software, on Tuesday that it would buy game maker Activision Blizzard for nearly $70 billion is an example of this activity. Regulators declined to comment on the deal.

Microsoft can argue, fairly, that acquiring Activision Blizzard won’t give it monopoly control of video games. It cannot argue, though, that the acquisition doesn’t set the company up for continued future dominance by buying a company that competed with it.

How might Microsoft dominate gaming in the future? The company announced that Game Pass, a Netflix-like subscription that gives gamers access to more than 100 premium titles for $10 to $15 a month, had grown to 25 million subscribers — up from 18 million a year ago. One reason it’s growing so quickly is that Microsoft makes the blockbuster games produced by its own studios available on the service at no extra charge the same day they go on sale to the public, where they often sell for $60 or more. Microsoft keeps buying game studios, in part, to beef up that offering. The company owned 10 studios when Satya Nadella became CEO in 2014; if the Activision deal closes in 2023 as planned, it will own 30. Among its high-profile acquisitions is Bethesda Softworks, which it acquired as part of a $7.5 billion deal that closed last March. Bethesda makes some of gaming’s most popular franchises, including Fallout, The Elder Scrolls, and Doom.

The future Game Pass is likely to include new games from those series, as well as Call of Duty and everything else Activision will bring. Gamers choosing between consoles will thus have to decide whether to pay $10 a month to play all of those on their XBox Series X, or $70 to buy just one of them on their PlayStation 5 — if it’s available on PlayStation at all.

Perhaps none of this will raise hackles at the FTC. If the market for video games eventually consolidates into four or five big players selling subscriptions, it will mostly just resemble our current market for streaming TV and movies. If prices stay low and consumers have abundant choices, maybe it’s nothing to get too worried about.

But that increasingly feels like an older view — one from before a time when the United Kingdom is taking action to stop Meta from buying a dying GIF search engine. And scrutinizing Microsoft’s planned $19.7 billion acquisition of speech recognition technology provider Nuance. In the United States, Khan’s FTC is now reportedly probing competition practices at Meta’s Oculus — at a time when the total market for VR games is perhaps only $8 billion in total.

Microsoft’s effort to acquire Activision is a characteristically shrewd move from Nadella and his team. And gamers, who have undeniably suffered under Kotick’s reign, may find that Microsoft is a much better steward of Activision’s franchises. (Minecraft, which Microsoft acquired for $2.5 billion in 2014, has thrived there.)

But it’s also true that, should the deal close, we’ll have taken another step down the road to a world ruled by mega-platforms. The coffeehouse chatter in the D.C. Bubble is that the FTC and Justice Department will consider deeply what second-order consequences might arise from such an economy. Based on that FTC/DoJ press conference, it would be no surprise.

Why does Microsoft want to buy Activision Blizzard? It wants to be a Netflix for games. And Microsoft is betting on a future more focused on games than hardware.

And, oh, the money. Will Bedingfield, a staff writer at Wired magazine who covers video games and internet culture who I met several years ago at the Mobile World Congress in Barcelona and who got me into the gaming culture, summed it up well on his blog:

Microsoft’s war chest is a dynamo. With revenues that rival the GDP of a small nation, it’s got enough cash on hand to buy whatever it wants. When it does, it just acquires another money-making machine. Its latest gadget? Video game company Activision Blizzard, which Microsoft announced yesterday it was buying for a staggering $68.7 billion—more than the $26.2 billion it paid for LinkedIn in 2016, almost 10 times the $7.5 billion it paid for Bethesda’s parent ZeniMax Media last year. Microsoft now owns Call of Duty and Halo; it owns The Elder Scrolls and World of Warcraft. It owns Candy Crush. It also owns Diablo, Overwatch, Spyro, Hearthstone, Guitar Hero, Crash Bandicoot, and StarCraft. Its chest is full—but not with machines.

As he told me, it’s tempting to view the acquisition as the latest shot fired in the console wars, a ploy to use Activision Blizzard’s deep catalog to sell Xboxes. But that would be shortsighted. If anything, he said

the deal shows that Microsoft is far more concerned with acquiring gamers—it’ll gain 400 million monthly active players as part of the deal—than with moving units. Read the PR : “The fantastic franchises across Activision Blizzard will also accelerate our plans for Cloud Gaming allowing more people in more places around the world to participate in the Xbox community using phones, tablets, laptops, and other devices you already own.” This is Microsoft’s move to a post-console world. It’s not about getting you to buy a gadget; it’s about luring you into an ecosystem. THAT’S the name of the game!

And he told me “watch/listen to the interviews.

So I did. When discussing online video game services like Stadia, Sony’s PlayStation Now, and Microsoft’s Cloud Gaming, insiders often reach for the same descriptor: X is “Netflix for games.” The goal of each service is to become a player’s go-to hub, month after month. Indeed, Phil Spencer, who, with the acquisition will be anointed CEO of Microsoft Gaming, used this comparison … again: “You and I might watch Netflix. I don’t know where you watch it, where I watch it, but we can have conversations about the shows we watch. I want gaming to evolve to that same level.”

This is telling, particularly because of just how much it belies Spencer’s seeming indifference to where people play Microsoft titles. That in itself is a repudiation of the console wars, which have historically been tied to Nintendo, Microsoft, and Sony’s alluringly shaped plastic boxes. These “walled gardens” Spencer said, are a “1990s construct” that he’d like to see dismantled. Microsoft’s new ownership of Candy Crush fits into this vision, giving the company an immediate presence in mobile gaming that transcends discussions of Xbox Series X. Or even better, Joost van Dreunen, a New York University business professor and author of One Up, a book on the global games business which became my primer to understand this industry, who was interviewed about the deal:

They’re not getting out of consoles, but they’re trying to reduce the degree to which they’re tethered to the Xbox. That’s just going to be one of the entry points into their ecosystem.

The goal here is one streamlined service—Activision Blizzard’s back catalog is the carrot for attracting users into that space. It could take 12 to 18 months for the deal to close (I see antitrust issues that will delay but not kill the deal), but when it does, Microsoft will offer as many Activision Blizzard games as we can within Xbox Game Pass and PC Game Pass, both new titles and games from Activision Blizzard’s catalog. They clearly see gaming as an entry point that leads to a much broader universe. The Game Pass service has benefited greatly from this.

Microsoft’s focus on Game Pass can have knock-on benefits. Another contact of mine, Alex Connock, a fellow in management practice at Oxford University in the UK (and who runs Oxford’s program “Artificial Intelligence for Business”, a kick-ass, practical course on AI) said:

This creates what’s known as a “flywheel,” where more subscribers fund more content, driving more subscribers. Subscription models are much more reliable than one-off software purchases. Look at the numbers: Game Pass just topped 25 million subscribers; the Activision acquisition may bring in many more.

Of course, it isn’t just subscriptions. Unlike Netflix, which is largely non-interactive, gaming has a social fabric all its own. Once you lure the player into these ecosystems, it’s a lot easier to up-sell them on things like in-game purchases and battle passes. Microsoft’s contention in its PR that the Activision Blizzard purchase is “a building block for the metaverse” fits into this narrative. The term has been much maligned – aren’t many games already metaverses? – yet whatever these spaces eventually end up looking like, it will be games that draw us into them. Meta knows this, of course; just look at how many people FarmVille lured onto Facebook.

There are issues. Short term, players are likely to fret over which games might become Microsoft-only titles, although it has already been suggested the company plans to continue offering Activision Blizzard games on Sony’s PlayStation but will also offer Xbox exclusives. But in the long term, exclusives don’t seem to be central to Microsoft’s strategy. I think they are ultimately trying to gobble up the whole of the ecosystem rather than make a few dollars per unit or per user by keeping things in pieces.

And, of course, the pure cloud play. No, consoles aren’t, just yet, going to vanish into the cloud. Sony, for example, still remains committed to the strategy of offering exclusives and selling PlayStations – and they continue to outsell Microsoft console for console. And there are still serious structural concerns about the viability of cloud gaming. But we are seeing (yet again) the emergence of a new model that is changing the dynamic between physical goods and digital services and thereby impacting the existing competitive landscape.

van Dreunen, in his book and in interviews over the past few months, says that the “Console Wars” and the fragmentation of how players access games has been a source of frustration for gaming companies and gamers themselves for years. All concerned say mass consolidation could be a way to end those headaches. And that feels like a quite possible endgame; the Microsoft news brought rumblings of other tech giants eyeing studios like EA and Ubisoft. But players may rightly wonder how these mergers and acquisitions will throttle creativity. Games are, at bottom, still an art form. Microsoft’s move may be a shift away from gaming machines, but it’s also a move toward an industry of nothing but cogs.

The metaverse – a catch-all term for an immersive experience that blends the physical and digital worlds through a mixture of virtual and augmented reality – is (somewhat) the point here. Yes, the concept is years away from being fully realised, but as I noted in my opening, lots of terms are created well in advance of any actual product. But then it just happens. Microsoft’s acquisition of Activision Blizzard demonstrates what I mean. With the Activision deal Microsoft has made it very clear that gaming will be at the centre of how metaverse concepts work. And it is not just using the games, but also deploying the creative and technical talent behind them to build virtual worlds.

But, of course, I would be remiss (it’s the cynic in me) if I did not note one other issue: the timing. The distraction.

Think back to late 2020 when news of the SolarWinds’ supply chain misstep circulated. FireEye (now part of Norton and renamed Trellix) reported the fact that a vaunted cyber security outfit (namely FireEye itself) was compromised. In short order, security professionals issued emergency directives, tried to figure out what happened, and how many entities were compromised. Microsoft suggested that the issue was a result of 1,000 programmers beavering away in Eastern Europe. Rumors surfaced that the SolarWinds’ misstep had taken place months, possibly more than a year, before the FireEye announcement in December 2020. Public disclosures about breaches appeared after lawyers and public relations professionals became consummate wordsmiths.

And many pundits, consulting firms, investment outfits, and even SolarWinds itself realized that “a certain large software company’s systems and methods” were the surf board the bad actors were riding across the flows of digital data. How do some individuals and companies respond when one subject — in this case, questionable engineering, insecure systems, and a snappy security breach that left US government agencies wondering who was pawing around in their allegedly secure servers — dominated the headlines. Well, distraction. I interpreted the launch of what is known as Windows 11 as that distraction.

Pundits took the red herring and gnawed. Familiar functions were suddenly unfamiliar. The October 2021 release of Windows 11 caught some people by surprise. It clearly was not ready. My view was that Windows 11 was pushed out in order to create a point of discussion of some magnitude. My view is that chatter about Windows 11 would help mute the conversation about Microsoft security and its engineering practices.

Hey, I full admit – a contrarian view. And I have outlined above why the Activision deal makes sense, plus the antitrust issues certainly to be gnawed. But Microsoft certainly has used a major, super deal to focus attention away from matters like the security of Azure, Exchange, and even the kicked-to-the-kerb Word application. My view is that security issues remain the most important think vis-a-vis Microsoft software systems. How did 2022 begin? Microsoft kicked off 2022 with 96 security patches. 96. Beyond belief. But hey – let’s talk about games, shall we? Although I ponder if Microsoft might best apply some of those billions toward addressing security issues and not gaming. But that’s just me.