Zero due diligence, a lousy analysis of the company, and management missteps all along the way within its own Board of Directors.

13 February 2024 (Brussels, BE) – More than a decade ago, Hewlett-Packard acquired Autonomy plc.

Then it blew up as Hewlett-Packard announced that it was taking an $8.8 billion accounting charge after claiming “serious accounting improprieties” and “outright misrepresentations” at Autonomy. It would eventually turn out that Hewlett-Packard’s due diligence for such as massive acquisition was pathetic, coupled with massive mismanagement.

Autonomy was one of the first companies to deploy what we’d begin to call “smart software.” The system used Bayesian methods, still quite new to many in the information retrieval game in the 1990s. Autonomy kept its method in a black box assigned to a company from which Autonomy licensed the functions for information processing. Some experts in smart software have overlooked BAE Systems’ activity in the smart software game. That effort began in the late 1990s and was considered better at the time. But few “experts” today care, but the dates are relevant.

Between the date Autonomy opened for business in 1996 and HP’s decision to purchase the company for about $8 billion in 2011, there was ample evidence that companies engaged in enterprise search and allied businesses like legal work processes or augmented magazine advertising were selling for much less. Most of the companies engaged in enterprise search simply went out of business after burning through their funds, Delphes and Entopia to name but two. Others sold at what the market thought were inflated or generous prices. For example, Vivisimo to IBM for about $28 million and Exalead to Dassault for €135 million.

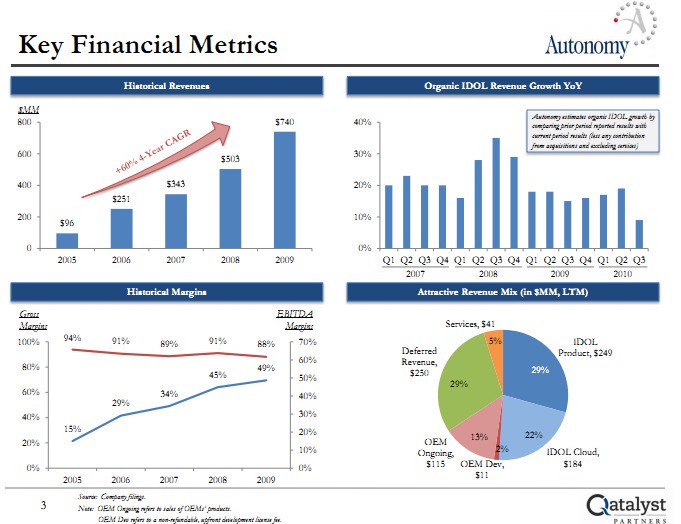

Then … BANG!! … along comes HP and its announcement that it purchased Autonomy for a staggering $8 billion. I was in London at the time at 451 Research (more about them below) at a an enterprise search-related event they sponsored and this PowerPoint slide popped up:

The idea was that Autonomy’s systems generated multiple lines of revenue, including a cloud service. The key fact on the presentation was that the search-and-retrieval unit was not the revenue rocket ship. Autonomy had shored up its search revenue by acquisition; for example, Soundsoft, Virage, and Zantaz. The company also experimented with bundling software, services, and hardware. But the Qatalyst slide depicted a rosy future because of Autonomy management’s vision and business strategy.

Did I believe the analysis prepared by Frank Quatrone’s team, Quattrone being the head of investment banking firm Qatalyst Group which was hawking Autonomy?

I accepted some of the comments about the future, but I was skeptical about others. And that was because at the time I was working on a media project with Nick Patience, co-founder of 451 Research. Nick is the smartest financial analyst I have ever met. He kiboshed the whole Autonomy thing. But most everybody else was salivating – especially those in the e-discovery community – “like Pavlovian pups at the mere mention of anything that smacks of meaning-based coding capabilities (like Autonomy’s IDOL tools)” to quote the great Craig Ball.

Nick reminded me that in the period from 2006 to 2012, it was becoming increasingly difficult to overcome some notable failures in enterprise search. The poster child from the problems was Fast Search & Transfer. In a nutshell, Fast Search retreated from Web search, shutting down its Google competitor AllTheWeb.com. The thing was that everybody was saying the future was enterprise search.

But some Fast Search customers were slow in paying their bills because of the complexity of tailoring the Fast Search system to a client’s particular requirements. One vendor told me he was asked to comment about how to get the Fast Search system to work because his team had used it for the FirstGov.gov site (now USA.gov) when the Inktomi solution was no longer viable due to procurement rule changes. Fast Search worked, but it required the same type of manual effort that the Vivisimo system required. PITA.

Search-and-retrieval for an organization is not a one size fits all thing, a fact Google learned with its spectacular failure with its truly misguided Google Search Appliance product. Fast Search ended with an investigation related to financial missteps, and Microsoft stepped in in 2008 and bought the company for about $1.2 billion. Yes, a wild and crazy number, but Microsoft was able to get people who managed to get Fast Search to work and thought that most licensees would not have the resources or talent they had at their disposal. They just needed “volume business”.

So $1.2 billion for Fast Search? There were better and cheaper options, and Microsoft eventually realized its mistake.

I’ve stayed abreast of the H-P/Autonomy/Mike Lynch (Autonomy’s founder) lawsuits, but it is a collateral interest. Lynch is also the major co-founder of Darktrace, a major cybersecurity vendor that uses AI to interrupt in-progress cyber-attacks, and uses AI to battle ransomware, email phishing, and other cyber threats. Lynch plays no part in its operations and is not on its board but maintains a significant financial interest.

So earlier today I read “HP Claims $4 Billion Losses in London Lawsuit over Autonomy Deal“. What is the Reuters’ news story adding to this background I gave you? Nothing, really. But the news story focuses on one particular factoid.

Keep in mind that HP paid $11 billion for Autonomy. Keep in mind that was 10 times what Microsoft paid for Fast Search.

Now HP wants $4 billion. Stripping away everything but enterprise search, I could accept that HP could reasonably pay $1.2 billion for Autonomy. But $11 billion made Microsoft’s purchase of Fast Search less nutso. Because, despite technical differences, Autonomy and Fast Search were two peas in a pod. The similarities were significant. The differences were technical. Neither company was poised to grow as rapidly as their stakeholders envisioned.

When open source search options became available, these quickly became popular. Today if one wants serviceable search-and-retrieval for an enterprise application one can use a Lucene / Solr variant or pick one of a number of other viable open source systems. People usually flock to the “usual suspects” because those suspects do great brand marketing and people are just too lazy to lazy to do their own research.

But H-P bought Autonomy and overpaid. Furthermore, Autonomy had potential, but the vision of Mike Lynch and the resources of H-P were needed to convert the promise of Autonomy into a diversified information processing company:

• Autonomy could have provided high value solutions to the health and medical market

• Autonomy could have become a key player in the policeware market

• Autonomy could have leveraged its legal software into a knowledge pipeline for eDiscovery vendors to license and build upon

• Autonomy could have expanded its opportunities to license Autonomy stubs into broader OpenText enterprise integration solutions.

But what did HP do? It muffed the bunny. Mr. Lynch exited and set up a promising cybersecurity company (Darktrace) and spent the rest of his time in various courtrooms. The Reuters’ article states:

Following one of the longest civil trials in English legal history, HP in 2022 substantially won its case, though a High Court judge said any damages would be significantly less than the $5 billion HP had claimed. HP’s lawyers argued on Monday that its losses resulting from the fraud entitle it to about $4 billion.

If I still wore a younger man’s clothes and still had his younger energy I’d write more about enterprise search. It is far, far more interesting that eDiscovery search. But the latter is merely a child of the former so I (kind of) do write about every now and then.

BOTTOM LINE: as has been chronicled in a tsunami of articles, H-P made a piss-poor decision based on zero due diligence, and now years later it wants Mike Lynch to pay for its lousy analysis of the company, its management missteps all along the way within its own Board of Directors, and its decision to pay $11 billion for a company in a sector in which at the time simply being profitable was a Herculean achievement.

So this dinobaby says “Caveat emptor dude”.