ByteDance is the original Red Dragon Era company. All of this is yet another indicator of the “Age of Cognivity”. Although that’s a generational perspective. Maybe it’s more like the age of the commercial “weaponization” of AI.

Thanks to TikTok I have a new muse

8 July 2021 – Online shopping is going through a major shakeup, and China is the epicenter. It is much, much more than that. But let’s start with shopping. Verdict declares “Watch Out Amazon, TikTok Is Coming for You with Short-Video Ecommerce”. Writer Elles Houweling introduces us to “618” (June 18th), an annual Chinese cybershopping festival that combines advertising with entertainment. Alongside traditional tactics like exclusive offers and discounts, retailers compete for attention with interactive live streaming events and the participation of internet influencers. Transactions can be made right on the social platforms that engage customers, smoothing the path to profits. Such developments may be no surprise from the nation that has the highest rate of ecommerce, according to research firm GlobalData. Houweling writes:

“Something that may come as news, however, is the speed at which short-video apps and live streaming ecommerce are taking over. Relatively new to the 618 game are social media platforms Douyin (China’s version of TikTok) and similar apps Kuaishou and Xiaohongshu, which are rapidly making their mark in the world of ecommerce. These apps have achieved something that traditional online retailers have long neglected: seamlessly merging shopping with entertainment. Chinese netizens are increasingly turning to social media platforms to make purchases. In the West, TikTok is not yet widely associated with the idea of ecommerce, but this may soon change.

Recently, TikTok announced that it had entered into partnerships with several companies, including Wal-Mart, Shopify and L’Oréal, to bring the app’s ecommerce platform to a Western audience. We may soon find a cohort of Millennials and GenZs not only learning their latest dance moves from TikTok but also buying their daily products, a trend that may threaten well-established ecommerce behemoths such as Amazon. Moreover, social media platforms have introduced new forms of cybershopping. Soon short-video advertisements and live broadcasts may replace the traditional search and click model of online retail.”

TikTok is now testing in-app sales features in Europe. Wal-Mart just partnered with TikTok on live-stream shopping, a move GlobalData sees as a real threat to Amazon. Though that company now has Amazon Live, the feature seems unlikely to capture nearly as much attention as TikTok will command on Wal-Mart’s behalf. The article notes one of TikTok’s strengths is its recommendation algorithm, which factors in what users do not like as well as what they do. The AI’s uncanny knack for discerning preferences makes for a strong marketing advantage. Perhaps that was the plan all along?

Hmmm. Didn’t some hyperactive rich person call this method ACommerce? The A? It does not mean what you think it means. The A is for algorithmic. And that is where the story gets interesting.

Never mind shopping. ByteDance, the TikTok parent company, is on its way to becoming a major gaming and Ed-tech company. The American TikTok branch is tightly controlled by Beijing based ByteDance, and the Communist Party of China has a very tight control on ByteDance. It’s their global bet on the future of consumer apps.

For a long time ByteDance pretended it wasn’t an AI or algorithmic company. It was taboo to mention it. But now it’s a bonafide AI B2B company. As scores of programmers and tech analysts have written, TikTok’s AI is so much better than 99% of the recommendation engines out there, and it is becoming an ever useful product for companies.

ByteDance has even begun selling some of the artificial-intelligence technology that powers its viral video app TikTok to websites and apps outside China, as it broadens its revenue streams ahead of a long-anticipated initial public offering in 2023. It’s doing that through a new division called BytePlus which it quietly launched in June and already lists customers all over the world, including in the U.S.

According to its website, its client list includes U.S. fashion app Goat, Singapore travel site WeGo, Indonesian shopping app Chilibeli, and India-based social gaming platform GamesApp. This positions ByteDance as an AIaaS leader (“AI as a Service”). It could be popular for consumer facing companies since its algorithm is certainly among the best. It is expected to add several more major U.S. retailers by the fall.

In a TechRadar briefing chat this week it was pointed out that BytePlus offers businesses the chance to tap some of TikTok’s secret ingredient: the algorithm that keeps users scrolling by recommending them videos that it thinks they will like. They can use this technology to personalise their apps and services for their customers.

Other software on offer includes automated translation of text and speech, real-time video effects and a suite of data analysis and management tools. Its computer vision technology can detect and track 18 points around the body from head to feet as users dance or gesture in front of the camera, which BytePlus suggests could be used for beauty or fashion apps.

Other points made in that TechRadar briefing chat:

▪️ The new unit has recruited staff in Singapore, its main hub, as well as London and Hong Kong, from enterprise technology companies including Microsoft and IBM, according to employees’ LinkedIn profiles. Tianyi He, a six-year ByteDance veteran who graduated in computer science from Tianjin University in 2014, is listed on LinkedIn as head of BytePlus in Singapore since June. A 15-second promotional video, entitled “Hello, World!” was posted to LinkedIn last month.

▪️ BytePlus’s toolset appears to compete with AI services from the likes of Amazon Web Services, Google, IBM and Microsoft, as well as other Chinese groups such as Alibaba, Baidu and Tencent. The international debut of BytePlus follows the launch of a similar business-to-business service in China. Volcano Engine, or Volcengine, counts JD.com, Vivo and Geely among its customers.

▪️ ByteDance’s first enterprise product, a corporate collaboration app called Lark, launched in 2019, as an alternative to Slack or Microsoft’s Teams. Its deeper push into corporate technology comes as the rapid growth of TikTok and its Chinese incarnation, Douyin, threatens to reach a ceiling, as online audiences saturate. ByteDance is testing a range of new products to diversify away from TikTok, both inside China and internationally, including mobile games and video-editing apps.

▪️ Online records suggest that ByteDance has sought to register trademarks associated with both BytePlus and Volcano Engine in the U.S., although it is unclear whether the company has opened an office there yet.

▪️ BytePlus’s privacy policy suggests that the business is incorporated separately to TikTok in the UK and Europe. In the UK, it points to its designated representative as Cosmo Technology Private Limited, while in Europe the organization responsible is Dublin-based Mikros Information Technology Ireland Limited.

In 2020, ByteDance reported a 93% increase in gross profit to $19bn, according to an internal memo released to staff, due to a surge in advertising. It’s the 5th company to be worth over $1 Trillion, so it’s not a one trick pony. And as I noted in my own briefing note earlier this year it’s investing in gaming and other verticals to a significant degree. It’s social commerce can fuel E-commerce growth. It will eventually be a leading Ed-Tech company as well, likely as soon as 2025.

ByteDance has over $9.4 Billion in funding and has yet to go IPO. Based in Beijing, it’s very likely state-backed.

ByteDance’s BytePlus features are still a must-have for many consumer brands that have apps where their customers view their products. BytePlus is an incredible opportunity for Western consumer facing brands to adopt the best AI. With their humble CEO stepping down in the Chinese crackdown, you have to assume the State now has a lot of oversight as to this company’s direction. It’s boss, Zhang Yiming, is a product visionary genius that puts Mark Zuckerberg and even Evan Spiegel to shame.

ByteDance explained in a blog post last year how its ForYou feed determines what videos to serve a given user. Its recommendations are based on user interactions including which videos you like, share comment on, or create; video information, such as captions and hashtags; and device and account settings including what device you’re using, your language preferences, and your location settings.

And that is what is driving customers to it: the chance to access the recommendation algorithm, and personalize it for their apps and customers. Go to the BytePlus web site and you’ll find for sale:

– a recommendation algorithm

– Personalization and white-label AI

– Automated speech and text AI

– Real-time video effects (AR)

ByteDance puts out app after app that become very popular. It doesn’t need to acquire companies or copy their product features. It doesn’t need to monopolize an entire innovation vertical or create a huge moat to maintain dominance. It doesn’t need to do these things because it has the best app product team with the best engineering AI.

BytePlus also offers AR features. This includes body motion SDK. So essentially ByteDance is selling computer vision expertise to clients and industry-leading algorithms. More Western brands will need their apps powered by the best. The new unit will help other companies personalize their websites and apps. BytePlus could be a very lucrative AI B2B unit of the company, even as they find more ways to diversify revenue streams.

The reality is ByteDance did more to power digital transformation in 2020 than even Microsoft. Most just don’t know it yet. China is the world’s largest gaming market, generating revenues of $40.85 billion in 2020, according to market research firm Newzoo. ByteDance is the next global gaming company that could become dominant in the 2020s. ByteDance has done with social commerce on Douyin in 2020 and 2021 what Facebook couldn’t do on Instagram in five years. They are moving just so much faster, it’s putting Silicon Valley duopolies to shame.

ByteDance isn’t just a consumer apps company, it’s a gaming company, an e-Commerce company, an ads giant, an Ed-tech company and an AI-company. Coupang and ByteDance alone make Softbank look good, even with all their horrible blunders. With ByteDance selling its AI and AR expertise to B2B clients, it’s pretty exciting for the democratization of AI.

Why didn’t LinkedIn upgrade to BytePlus? Well, it was contemplated. Analysts say if Microsoft had decided to use BytePlus’s features for LinkedIn, their B2B Ads revenue would immediately increase more than anything they are currently doing. LinkedIn’s AI algorithm is notoriously bad as millions of users can attest to. Many of which who don’t even log on on a monthly basis due to this.

Microsoft does not have a native recommendation engine that performs among world leaders. ByteDance has more experience than any other firm in refining its recommendation engine with Toutiao, Douyin and others apps. They have gotten so good it’s an absurd disruptive AI advantage. Now with BytePlus, other companies can adopt in.

There’s some evidence in 2021 ByteDance will make headway against Alibaba in social commerce, headway against Tencent in gaming and so forth. It’s using its AI as a competitive advantage and could become a sprawling B2B and ads empire because of it. And now it’s appearing like ByteDance might compete with Microsoft on the B2B of AI as BytePlus can attest to. If only Microsoft had acted faster to acquire TikTok U.S. when it had a small window.

As for how to follow the money with ByteDance’s (cash bleeding) growth it’s likely not an issue for Softbank and the over 30 investors who fuel ByteDance’s growth. This means they can burn more cash than others to grow, and the results are showing a new paradigm, one where the Chinese internet and its tech overtakes the influence of the American internet giants eventually. Let’s face it, ByteDance is likely developing the next social network for global professionals as we speak. America can’t even clone Chinese tech fast enough to keep up as evident with Instagram pivoting to the TikTok full-screen model. Silicon Valley has been left behind in the AI-wars for the next internet.

We are in the “Age of the Creator” as my staff at Project Counsel Media pointed out earlier this week. Silicon Valley knows that and they are adding creators but they are choking on “we’re making a lot of money, thanks”. When you are making as much as Facebook, YouTube (or even LinkedIn for that matter) in ad revenue, the user experience and product innovation aren’t particularly high on your list because you think you own a monopoly on the segment. But in today’s world, when consolidation is based on AI-trends, the superior AI in the end becomes the last platform.

China has done more in the last five years in AI, space and mobile innovation than the U.S. has done in the last 20. Yes, Google’s surveillance capitalism model has been improved upon at scale. Wow. Good job. Meanwhile, ByteDance has engineered a company (one of many) built to replace Silicon Valley via content.

What kind of content? Youth content. TikTok, by expanding its video lengths, by augmenting its algorithms, will be expanding into more useful content with these moves. Why would a young person go on YouTube with all that competition and slow her/his path to monetization? TikTok has the potential as it’s leading in distributive tech for entertainment. While both platforms are obviously using advanced AI, TikTok has the better recommendations.

Granted, YouTube has the advantage of channels, search capability and the presence of many organizations working in many different areas from social to private sector to government. Also, it has cross-platform compatibility with others like Zoom and Facebook which makes it convenient.

However TikTok is always, always innovating. Silicon Valley is already getting nervous with their jump in gaming and music streaming. As one analyst at Cannes Lions said last week:

“ByteDance could easily become a leading media company. That it is becoming a leading ad player is already inevitable. Then it will diversify into more profitable B2B verticals like it has with BytePlus”.

All of this will be lucrative and certainly super-charge CCP surveillance capitalism going global. Softbank will re-invest in them, and one expects the IPO will be huge in 2023.

Yes, yes. Netflix will eventually get into gaming as it has said, but in the streaming consolidation there won’t be room for many players.

And as the second largest search engine, Youtube ain’t going away. Tiktok will have its work cut out for them in matching the search relevancy of content of YouTube. It also has a big advantage: it’s easier for content creators to post the same content from YouTube to Tiktok, but it won’t be as easy to consume content as YouTube which is used without age differentiation – not the case with Tiktok.

But it goes back to creativity. Whereas YouTube is a product built for consumption, TikTok is a product built for creation. TikTok gets a lot of credit for reimagining content consumption, but not enough credit for reimagining content creation. Its creation features are its more groundbreaking product innovation. There’s a reason that the most-followed people on TikTok are called “creators” and the most-followed people on most other platforms are called “influencers”. Because TikTok removed the friction to create so effectively that 1 in 4 users create content on TikTok, compared to 1 in 1,000 on YouTube.

In the early days of Facebook, Mark Zuckerberg found that new users were more likely to stick with Facebook if they made at least 10 friend connections in their first 14 days. In the early days of Twitter, Jack Dorsey noticed that user retention improved when a new user followed 30 accounts. Time-to-value for Facebook and Twitter—the time from sign-up to realizing the value of the product – is measured in hours, days, or even weeks. It takes time for new users to understand the value of Facebook or Twitter.

TikTok’s time-to-value is measured in seconds. One of TikTok’s key features is that it requires no account sign-up. New users download the app and immediately begin consuming content; there’s no friction and there’s no learning curve. Every 15 seconds or so, the algorithm serves a new video and a new emotional high.

Now, this isn’t a completely fair comparison, because TikTok isn’t really a social network like Facebook or Twitter – it’s a content platform more comparable to YouTube. But a new user to YouTube still needs to first select a video. Time-to-value is dramatically lower on TikTok because TikTok selects content for you.

But most importantly, when the original creator of TikTok was asked to explain his theory for creating new social networks he said new social networks needed early adopters to be young, creative digital natives with time on their hands. But it could only attract this group by giving them a reason to leave existing popular platforms. That reason, he said, was the possibility of becoming a star. And so instead of targeting already successful creators, it supported new ones, giving them tips on how to make content. A number have gone on to mainstream success with followers in the 70 million+ and making 100s of thousands of dollars.

This is the risk faced by Clubhouse as it begins dying out. It has continued to use big names to draw in new users. A lot of hype – and money —- riding on the app’s success.

Netflix and YouTube created paralysis: users were inundated with content and overwhelmed by choice. TikTok avoided this by deciding what the user should watch with AI. Earlier this year, TikTok revealed how its algorithm works:

“The app takes into account the videos you like or share, the accounts you follow, the comments you post and the content you create to help determine your interests. In addition, the recommendation system will factor in video information like the captions, sounds, and hashtags associated with the content you like. To a lesser extent, it will also use your device and account settings information like your language preference, country setting and device type”.

Other signals contribute to TikTok’s understanding of what a user likes, as well. For example, if a user watches a longer video from beginning to end, it’s considered a strong indicator of interest. This would be given a greater weight than a weaker signal, like if the viewer and poster were from the same country.

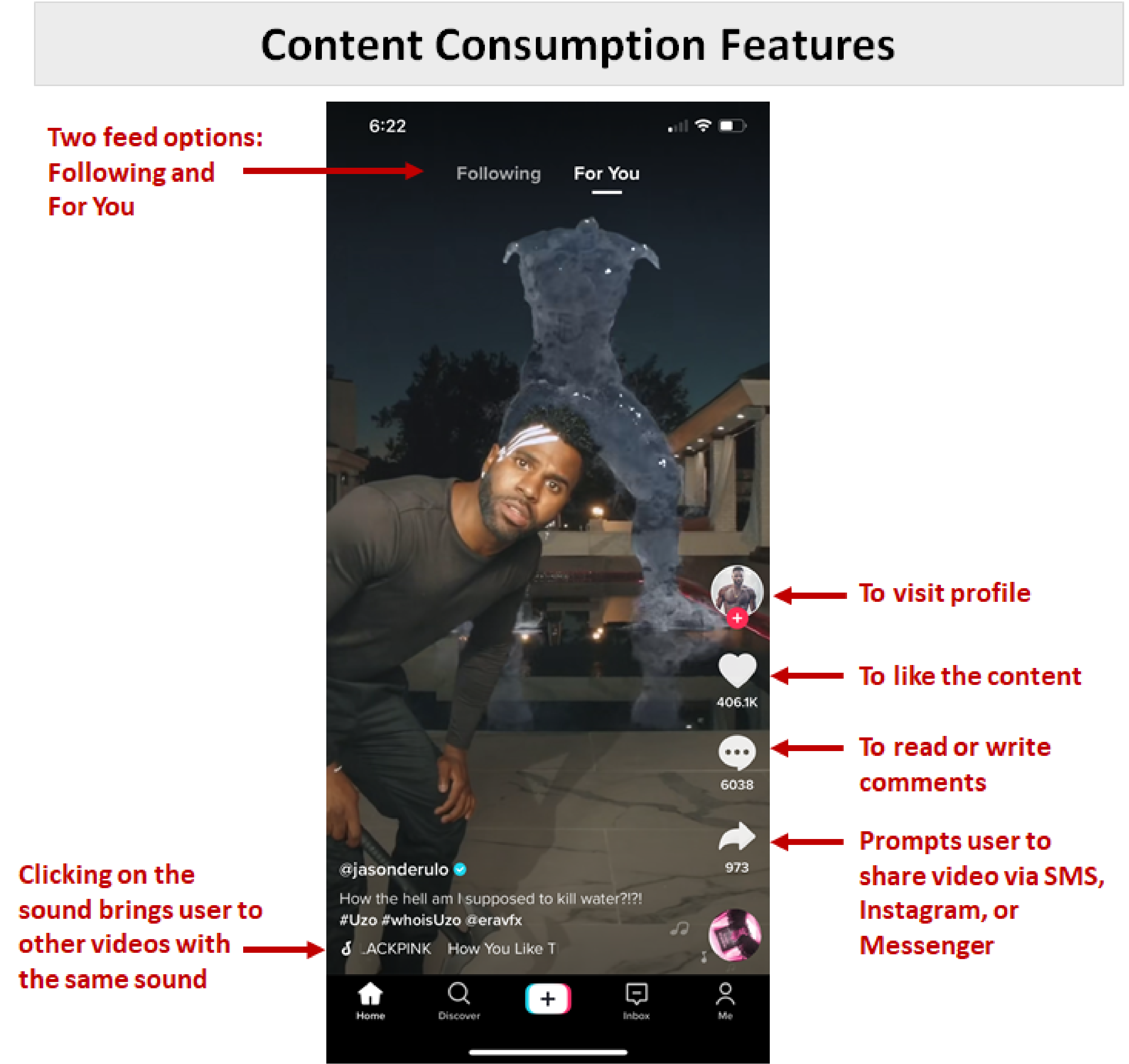

TikTok is optimized to hold your attention, serving a never-ending and constantly-refined stream of content. Because users don’t need to browse, TikTok can dedicate the entire feed to the content.

Opening TikTok, this is what I see:

There are a few features on the screen – liking and commenting, for example – but most of the screen’s real estate is dedicated to the content. And full-screen immersion goes hand-in-hand with audio immersion. It’s basically impossible to use TikTok in public without headphones.

Plus the viral growth loop. When sharing a post on Instagram, the default is to send a direct message within the app; Instagram keeps communication within its closed ecosystem. The feature to share the post externally is buried under a few more taps.

But when I go to share a post on TikTok, the first tap shows me a range of choices: SMS, Instagram, Instagram Stories, Messenger, Facebook, Twitter, and WhatsApp. TikTok tries to push me out of the TikTok ecosystem. This feature – making external sharing the default – creates a powerful viral loop for user growth.

Last year in a long post about COVID, the future of work, and tech Lightspeed’s Merci Victoria Grace wrote:

“Years ago, a common refrain in tech was that ‘Everyone is an engineer’, or would be soon. People would learn to code the way they learn to read or write and it would become a basic form of communication. Lately this has evolved into the much more believable ‘Everyone is a designer’. We are adopting/designing old tech and new tech for what will work for us now”.

I would broaden this to “Everyone is a creator”. This is as much a trend in consumer as it is in enterprise. Just as TikTok is giving users the tools to create videos, Roblox is giving users the tools to create game worlds and Niantic is giving users the tools to create consumer AR applications. “Low-code / no-code” isn’t the right term for this, but it’s close. Someone with no specialized knowledge can create professional-looking content by leveraging sophisticated but accessible technology.

This is what’s groundbreaking about TikTok: TikTok is the most visible in a growing set of creator-focused tech platforms. It is why, long-term, I think it will have an advantage over the incumbents.

CONCLUDING THOUGHTS: Algorithmic Revolutions

Instagram, from the very beginning, has been marked first and foremost by evolution. If you don’t work in this space or follow it like I do it may be hard to remember now, but Instagram didn’t even start as primarily a photo-sharing app: it was a photo-filter app, focused on making photos look good on ancient iPhone cameras and posting them on other social networks. It was, to use Chris Dixon’s parlance, a tool that evolved into a network. Instagram’s initial hook was the innovative photo filters. At the time some other apps like Hipstamatic had filters but you had to pay for them. Instagram also made it easy to share your photos on other networks like Facebook and Twitter. But you could also share on Instagram’s network, which of course became the preferred way to use Instagram over time.

This was certainly an innovative approach, but even then Instagram didn’t get off the ground in isolation: the app famously booted up its initial network on top of the Twitter graph, allowing you to easily discover and follow everyone you already followed on Twitter.

Instagram’s success in doing so remains one of the most powerful arguments for interoperability as a means of driving competition; it is disappointing that regulations like Europe’s General Data Protection Regulation (GDPR) have redefined privacy to make it impossible to carry your contacts to other services. But it also explains the seismic change brewing in the attention economy, and how Facebook, Google, Apple and others are redesigning that trillion-dollar paradigm so the GDPR and such laws as the California Privacy Rights Act (CCPA) will no longer matter. These ponderous discussions in the GDPR around data “processors” vs. “controllers”, or around “businesses’ and “service providers’” in the CCPA – essentially, convoluted debates around first vs. third party uses of data – will simply go away. Ditto the obsession around “personal identifiers” and how they’re trafficked around the convoluted ad tech game board above. The regulation which fixates on how your data gets into the cloud and how it’s labeled with your pseudonym becomes entirely moot.

The important takeaway for this article, though, is that Instagram was defined by evolution from the very beginning.

When I think about what Instagram is/was I think about moments, and I think about visual imagery. What I can tell you is that at our core visual imagery is everything. It’s in our DNA, and it’s what drives us. But while photos are certainly “moments” and “visual imagery”, they are only a subset. Video was the obvious evolution and TikTok showed the incumbents how it’s done.

And that’s my key take-away from almost 30+ years in digital media. One of the defining characteristics of digital services relative to analog services is that they need not be limited by medium: a magazine can only ever have photos, while a television show can only ever be videos, but when everything is 1s and 0s there is no need to be constrained by one particular manifestation of those 1s and 0s. Instagram has understood this from the beginning; the fact it started as only a photo app was due to the constraints of technology, not ideology.

It propelled Instagram into its third evolution: the introduction of the algorithmic feed, which was met with handwringing around the tech world. And consumers. Back in 2016 The New York Times got comments from not only analysts and Instagram executives but also a person-on-the-street. From one of those stories:

Vickie Mulkerin, a 49-year-old Instagram use said she appreciated the immediacy of the Instagram feed. “I like how I can open the app and see what my stepsister Ashley is doing today with my niece and nephew, right in that very moment,” she said. “I want to judge what’s important, not have some algorithm tell me what it thinks is important. Why did they mess that up?”

If you think that quote looks familiar, well, welcome to pretty much every story about the Facebook algorithm: users are sure they know better, but as any Facebook executive will tell you, users are much more engaged with an algorithmic feed. One common misconception about why Facebook has an algorithmic feed is that it is to allow for advertising; that, though, doesn’t really make much sense. Facebook could include advertising in a time-based feed just as easily; indeed, that’s what the company does with Instagram today. Rather, an algorithmic feed is exactly what Facebook says it is: a way to drive engagement by showing users more of what they actually want to see, and, by virtue of driving engagement, gaining the opportunity to show users that many more ads.

User research seemed to show that Instagram users said they use the app for entertainment, but I strongly suspect that the service is even more convinced by the way users actually use the app: Facebook knows better than anyone that, when it comes to their services, revealed preference – what users actually do – is a far more powerful indicator than stated preference — what they say they want. It turned out they loved and used the feed.

This was the biggest lesson from one of the most important episodes in Facebook’s history: the introduction of the News Feed, which was met by protests both on Facebook (naturally), and even outside of the company’s offices in Palo Alto. The irony, as David Kirkpatrick noted in his book The Facebook Effect, is that the reason protests sprung up so quickly is that the News Feed worked: it surfaced and organized information that users cared about in a way that was only possible with an algorithmically-driven Internet service. Facebook added some token privacy controls to mollify those initial objections, but the company didn’t compromise on the concept itself, which became the foundation of the company’s explosive growth and, it should be noted, was copied by everyone else – including Instagram.

Instagram’s biggest shift, though, and the episode from which you can draw a straight line to TikTok competition, was its introduction of Stories. While a feed was native to digital — endless content, customized to you — Stories (pioneered by Snapchat but poorly executed by it) were native to mobile specifically. They filled your entire screen and either advanced on their own or with a simple tap; their ephemeral nature was also a powerful lure to keep you coming back to the app day-after-day.

What was impressive about this shift was, in fact, the shamelessness. Pundits called it “The Audacity of Copying Well”. What differentiated Instagram was the product of its initial evolution – the network – and adding a new format to that network was, broadly speaking, no different than adding an algorithmic feed.

But then it declined, driven by … well, the Facebook push to monetize everything. Increasing usage of Stories increased impressions, which is deflationary, but as advertisers have embraced the format that has increased competition for those impressions, ultimately increasing prices. And users were flooded with ads.

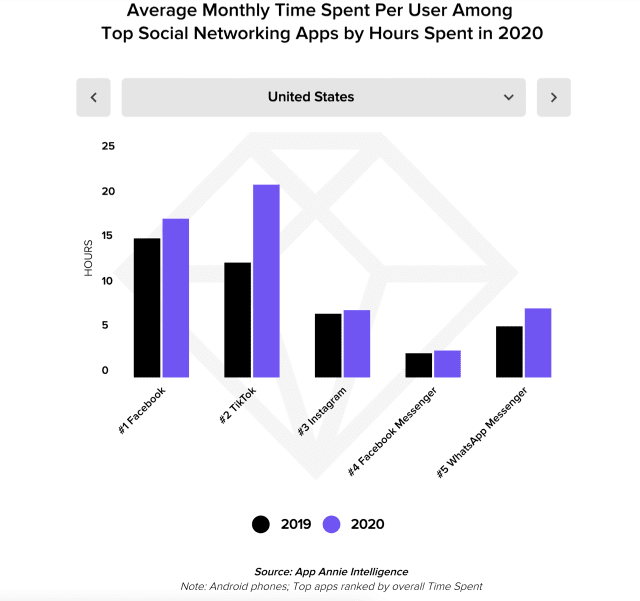

It’s why TikTok became such a serious competitive threat to both Facebook and Instagram. It got the algorithm, user and ad balance perfect as I noted above. App Annie reported in its State of Mobile 2021 report that in the United States time spent on TikTok had surpassed both the Facebook app and Instagram:

And while the FTC didn’t even mention TikTok in its antitrust case against Facebook – small wonder the suit was dismissed for lacking a reasonable market definition – this is clearly a big problem for an advertising-based business. The defining characteristic of digital is abundance, thanks to the zero marginal cost nature of transmitting 1s and 0s, which means that time, thanks to its inherent scarcity, is the most important plane of competition.

TikTok, though, has been particularly difficult for Facebook and Instagram to respond to for three reasons:

First, if Instagram has been defined by sharing moments, TikTok has been about manufacturing them, with easy-to-use tools that commoditize creation.

Second, TikTok has defined a new format, distinct from both a scrollable feed and tappable stories: swipeable videos that are melding of both. TikTok provides both an endless feed and a full-screen immersive experience that is easily navigable.

Third, TikTok isn’t really a social network at all, which freed the service to surface the most compelling content from anywhere in the world, not simply from your network.

The first issue was easier to address, which is how we came by Instagram Reels. Sure, it may not be as intuitive as TikTok’s video editor, but Reels is improving rapidly. The problem for Instagram, though, is that building tools is relatively easy; creating a virtuous cycle of creation and consumption is much more difficult.

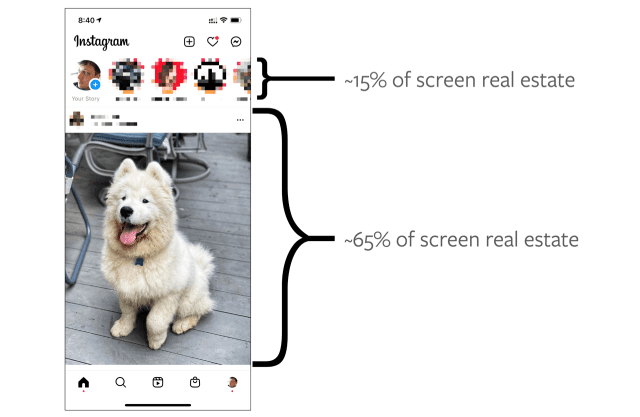

This is where the shift to Stories created an opportunity: if you look at the Instagram home screen, the vast majority of time is spent in a relatively small amount of space:

While Reels did recently get its own tab at the bottom, I suspect that Instagram’s plan is to push Reels content into that main feed that includes content from creators “you may not be following yet.” In other words, Instagram, having shifted the primary use case of the app from the Feed to Stories, is going to transform said feed to address its two remaining shortcomings relative to TikTok: a new consumption experience, and content from anywhere.

And if you look at my screen shot of TikTok earlier in this piece, you see how much better TikTok executes on this stuff.

It’s not certain Facebook and Instagram will succeed, and the risk is significant: the only thing harder than rewiring users’ expectations for a massively successful product is ensuring said rewiring doesn’t turn them off from the app entirely, destroying the very value you are trying to leverage.

But Zuck certainly knows the danger of standing still. Get the popcorn out. Instagram was Facebook’s smartest acquisition. The photo-sharing service is valuable because it is a network, but it initially got traction because of filters. Sometimes what gets you started is only a lever to what makes you valuable. What, though, lies beyond the network? That was Facebook’s starting point, and I think the answer to what lies beyond is clear: the entire online experience of over a billion people. Will Facebook seek to protect its network – and Zuckerberg’s vision – or make a play to be the television of mobile?

Six years on and it seems likely that Facebook’s usage is at best holding steady – it was reportedly declining before the pandemic – and at a minimum declining relative to the competition; meanwhile, the service has been transitioning to much more of a utility, with a greater focus on Groups and offerings like Marketplace. Perhaps that was ultimately the best path for an app so deeply tied to the idea of a social network, but it also gives that much more of an impetus for Instagram to shift to an even broader vision: a one-stop shop for entertainment on your phone.

Of course the network isn’t going away. But the main issue is likely something that Facebook and Instagram cannot overcome – TikTok’s construction, and the way it keeps users engaged, is fundamentally different to Facebook’s interest graph approach. Facebook has been able to defeat opponents thus far due to its ubiquity, and its vast data stores, which enable it show people more of what they like, from the people that they care about most. Its algorithm wins out by knowing who and what you engage with.

But TikTok, with its focus on public posting, as opposed to enclosed networks, opens up its content pool to the millions of videos uploaded to its app every day, which enables it to more accurately identify trends and interests, and align its feed with many more clips along those lines. And it’s not just its content breadth – TikTok only shows users one, full-screen video at a time, from which it can more accurately track specific interest signals, which again hones its recommendation engine.

As noted by industry analyst Eugene Wei:

“Everything you do from the moment the video begins playing is signal as to your sentiment towards that video. Do you swipe up to the next video before it has even finished playing? An implicit (though borderline explicit) signal of disinterest. Did you watch it more than once, letting it loop a few times? Seems that something about it appealed to you. Did you share the video through the built-in share pane? Another strong indicator of positive sentiment.”

As I noted above, TikTok’s algorithm, which incorporates machine learning based on video content, along with human categorization, is highly attuned to people’s specific interests, and it only takes a small amount of usage to learn what will keep you hooked. Which is why you find yourself scrolling and scrolling into the early hours, and why it feels more fresh than your regular social feeds.

Facebook and Instagram haven’t been constructed in the same way, though Instagram is trying to replicate the approach with Reels but it’s a weak alternative. The construction of TikTok’s app is geared specifically around that ultra-engaging main feed, and with Reels as an add-on within Instagram, it’s not the same, even if it can improve its recommendations and attune them more to individual interests.

Essentially, TikTok is seeing success by beating Facebook at its own game, and using implicit signals to optimize the user experience. Facebook now has to catch up, which is interesting to see, as it considers how it might be able to slow the app’s momentum, and avoid losing ground with younger users.

And for marketers, TikTok is the most important consideration for moving forward.

One Reply to “TikTok and the Algorithmic Revolution”